How AI is reshaping financial services

Artificial intelligence (AI) is fundamentally transforming the financial services industry, but not in the ways most people expect.

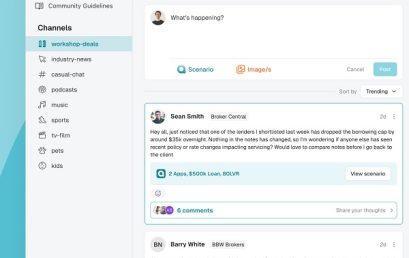

Quickli launches in-built mortgage broker Community

Quickli has launched a mortgage broker community engagement function on its widely-used interface at no extra charge, dubbed the Quickli Community.

OKX and Consensys announce strategic partnership, integrating DEX API for MetaMask and MEV protection for OKX Wallet

OKX and Consensys announce a strategic partnership that will enhance the onchain trading experience for millions globally through expanded trading capabilities and advanced user safety features.

Willis launches insurtech platform Zest Insurance, a digital revolution for Australian SMEs

Willis, a WTW business, have launched Zest Insurance, a cutting-edge digital insurance platform tailored specifically for SMEs in Australia.

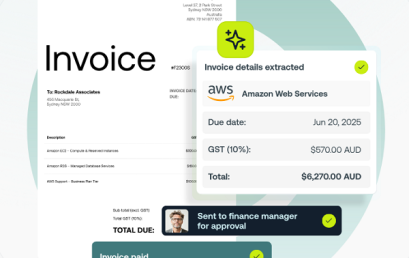

Weel launches AI-powered Accounts Payable solution

Weel has launched its all-new Accounts Payable automation suite – an end-to-end solution designed to eliminate the complexity of traditional AP workflows.

Cloudera’s Keir Garrett shares insightful information into AI, operational risk and compliance

Keir Garrett, Regional Vice President at Cloudera ANZ, shares insightful information into Artificial Intelligence, operational risk and compliance.

Mortgage Choice announces strategic partnership with tech provider NextGen

Mortgage Choice have announced a new partnership with technology provider NextGen, which marks the first phase of integrating open banking into the Mortgage Choice home loan application process.

Upcover and Lawpath partner to streamline legal and insurance services for Australian SMEs

Upcover and Lawpath partner to offer an integrated solution simplifying legal and insurance needs for small businesses and startups.