10th Annual FinTech & Banking Awards 2025 – Now open for submissions!

Australia’s first and oldest FinTech & Banking Awards, the 10th Annual FinTech & Banking Awards 2025, are now open for submissions.

Introducing Australian FinTech’s newest Member – Craggle

Craggle is an Australian fintech that was born to simplify every step of the home lending process and deliver better rates to Australians.

The FinTech Report Podcast: Episode 58: Alan Shields, Founder of RFi Data Insights

The FinTech Report Podcast: Episode 58: Glen Frost interviews Alan Shields, Founder of RFi Data Insights.

‘Use it or lose it’: AUSTRAC targets inactive Australian digital currency exchanges

AUSTRAC is encouraging inactive digital currency exchange businesses to voluntarily withdraw their registrations or risk having it cancelled.

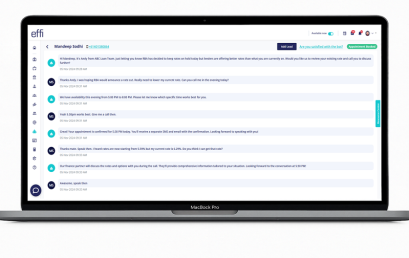

This Broker let AI do the talking – The results? Game-changing

A Melbourne-based broker has successfully refinanced more than $20 million in loans by utilising an AI-powered virtual assistant built by fintech startup Effi Technologies.

Kobble launches with $24.3 million in deals and raising to redefine embedded finance

Shane Chanel has launched embedded finance solution Kobble to transform how businesses deliver financial services.

The risks of waiting on compliance

It’s important for startups to establish robust security processes and earn key compliance certifications at an early stage.

Introducing Australian FinTech’s newest Member – x15ventures

x15ventures builds, buys, and invests in startups that would benefit from connections to Australia’s leading bank, and could improve the lives of its 15 million customers.