OwnHome launches Australia’s first 0% deposit home loan option to get more people onto the property ladder

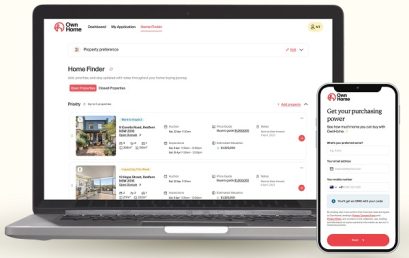

CBA-backed OwnHome today launched the Deposit Boost Loan – an Australian first that will help aspiring buyers secure a bank loan with 0% deposit.

IPEX to tackle threat of insolvency in the construction sector

IPEX has set its sights against the threat and damage of insolvency and non-payment in Australia’s $360 billion construction industry.

Bridging loan specialist Bridgit sees market changes and adapts product structure to meet new demand

Bridgit has been closely monitoring the needs of Australian homeowners alongside the recent market fluctuations.

PropHero celebrates its second birthday with continued market outperformance, new in-app feature and global move

Sydney and Madrid-based digital property investment platform PropHero has celebrated its second birthday!

Bridgit launches Single Security Bridging Loan

Bridgit, a non-bank lender specialising in bridging loans, has announced the official launch of its Single Security Bridging Loan.

The FinTech Report Podcast: Episode 34: Mark Macduffie, Founder, Downsizer

Downsizer radically changing property market for Gen X and Boomers. With Downsizer, anyone with sufficient equity in their current home can purchase a new dwelling with zero cash deposit.

PropHero appoints Sophie Hayek to the new role of CEO Australia as the award-winning proptech launches new features and accelerates global expansion

Digital property investment platform, PropHero, has appointed Sophie Hayek to the newly created role of CEO Australia.

Finance expert predicts older Australians will downsize sooner and a younger demographic of ‘downsizers’ will emerge in 2023

Consecutive interest rate rises, cost of living and the highest levels of inflation is putting pressure on households, but it is also providing an opportunity for older homeowners to re-assess their financial position.