DomaCom considers potential acquisition of Bricklet after securing loan funds and private placement

ASX-listed DomaCom Limited have announced that it has entered an agreement with property co-ownership marketplace operator Bricklet.

Autodesk to acquire Australian-headquartered fintech and proptech company Payapps

Autodesk has signed a definitive agreement to acquire Payapps, a leading global provider of construction payment and compliance management solutions.

New year, same old problem: How to protect projects without the existence of insolvency insurance

Despite the dawn of a new year, the generations-old challenge of insolvency looms as large as ever over property development.

Blockbuilder embarks on $4m capital raise to expand cashless deposits internationally

Blockbuilder has embarked on a $4 million capital raise to expand its cashless deposit solutions into the United Kingdom and United States.

Tic:Toc doubles down on platform technology, announces rebrand to Tiimely

Tic:Toc unveiled its rebrand to Tiimely, in a move designed to better reflect how the company’s AI-driven technology solutions can be integrated into any financial assessment processes.

PropHero launches new “PropHero Portfolio” app so property investors can track their portfolio performance for free anywhere in the world

PropHero launches PropHero Portfolio so property investors can have a clear view of their portfolio’s performance and track their investments anywhere in the world.

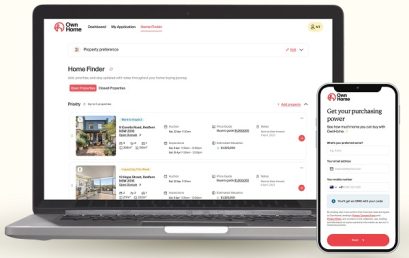

OwnHome launches Australia’s first 0% deposit home loan option to get more people onto the property ladder

CBA-backed OwnHome today launched the Deposit Boost Loan – an Australian first that will help aspiring buyers secure a bank loan with 0% deposit.

IPEX to tackle threat of insolvency in the construction sector

IPEX has set its sights against the threat and damage of insolvency and non-payment in Australia’s $360 billion construction industry.