Has Bitcoin entered a new normal?

Bitcoin has been experiencing low volatility recently, which could fuel greater adoption by enabling the cryptocurrency’s use as a medium of exchange. As for whether this will actually materialize, analysts have offered mixed views. Nigel Green, founder and CEO of independent financial consultancy deVere Group, forecasted that bitcoin’s modest price fluctuations will probably prompt greater use of the digital currency. While the digital currency’s price fluctuations have been “relatively modest” as of late, “volatility will return again,” he predicted. “However, there is a growing sense that crypto sector will have less extreme swings moving forward,” emphasized Green. “This is likely to further drive mass adoption.” To read more, please click on the link below… […]

Zip Co welcomes Chemist Warehouse to the platform

Digital payments platform, Zip Co (ASX:Z1P) has today announced a partnership with Chemist Warehouse retail group. Chemist Warehouse is Australia’s largest pharmacy retailer with revenue in excess of $5 billion and stores in 400 locations across the country. It’s expected that Zip will be live throughout Chemist Warehouse stores within the next two months. Zip CEO Larry Diamond says, the company is excited to partner with one of Australia’s top 10 retailers and expand their digital payment offerings. To read more, please click on the link below… Source: Zip Co welcomes Chemist Warehouse to the platform | Finance News Network

Why business enterprise should start accepting cryptocurrency as payments

Payments for products and services is something that has been going on since the beginning of humankind. The main change has been how it has been established. From changing to cryptographic forms of money, strategies for payment have changed drastically all through human history, and we are in the middle another rush of change. Many will feel that digital forms of money are the catalyst for the new payment revolution, yet those indicators are presumably losing track of the main issue at hand. Even though crypto works for new and different payment strategies, it is early compared with the latest trend. Cryptographic forms of money are fast in rising as […]

Is Ripple too far ahead of its time?

As Swift and Ripple vie for the future of cross-border payments, an article published in American Banker has shed some light onto the obstacles facing both brands. At the same time, Swift has taken a step towards blockchain by linking its payments standard – GPI, or Global Payments Innovation – to R3’s Corda blockchain. It’s likely to be a winner-takes-all market because getting everyone onto the same network is crucial for getting the most out of the technology. As such, now might be a pivotal time for Ripple. The uptake numbers are sitting in Swift GPI’s favour though. Swift says more than 450 banks, which handle over 80% of international […]

CBA plugs 500,000 customers into Apple Pay in just two weeks

The Commonwealth Bank of Australia’s backflip on its longstanding Apple Pay boycott has paid off in spades, with more than half a million people flocking to the new payment service just two weeks after it was made publicly available to customers. The stampede of iPhone users is so big it has boosted the CBA’s total number of mobile banking by half, propelling the number from 1 million Android users to a total of 1.5 million total mobile numbers. The fresh numbers were revealed to investment analysts this week by CBA chief executive Matt Comyn, who credited the bank’s customer engagement platform for the delivering the result, before outlining how robust […]

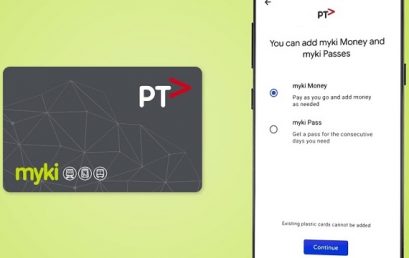

Modern myki miracle: Android users give thumbs up to mobile payment trial

It has all the makings of a public transport miracle: a rollout of new myki technology that isn’t plagued by huge problems. At least not yet. Commuters taking part in a smartphone myki payment trial have given the beta test a cautious thumbs up, heaping praise on the convenience of topping up remotely and the system’s decent touch-on speed. Android users started using their mobile phones to pay for fares on Victoria’s trains, buses and trams after Public Transport Victoria invited 4000 people to take part in the test-run last month. There is still work to be done to ensure everyone can benefit: iPhone users remain locked out of the […]

Twitter founder Jack Dorsey: Crypto will deliver a global currency

Jack Dorsey has a lot of thoughts and plans for cryptocurrency. In a February 2 interview with Joe Rogan, the Twitter founder and CEO had a lot to say about the topic. In a wide-ranging interview that covers topics of censorship, app development, politics and other topics, Rogan steered the conversation towards Dorsey’s Cash App, which allows users to buy and sell Bitcoin Core (BTC). Rogan asked why Dorsey’s team introduced cryptocurrency exchanges in the app. Quite simply, Dorsey believes in a future of one global currency, if it is or isn’t BTC, and that starts in small steps. He said: “I believe the Internet will have a native currency […]

Ezidebit goes back to childcare roots after 12 months on the sidelines

Payments solution group Ezidebit is making an aggressive push back into the booming childcare industry after 12 months on the sidelines. Ezidebit provides an integrated payments solution to streamline collecting of fees for childcare centres and Outside School Hours Care services, reducing time spent in reconciling payments. Ezidebit has more than 20 years’ experience in the childcare industry, with a dedicated team to support the segment, but has been excluded from operating in the sector since the sale of partner QikKids in early 2018 where it was previously the exclusive payments provider. Ezidebit Managing Director Australia and New Zealand Mark Healy said: “Our heritage is in childcare and we fully […]