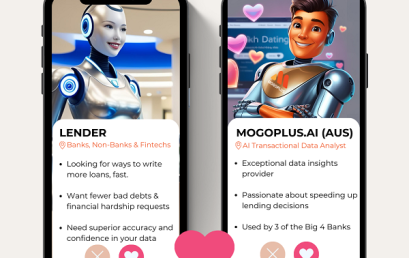

MOGOPLUS’ AI position is strengthened with Google Cloud partnership as lending insight partner-of-choice

Every Open Banking participant in possession of a valid accreditation is in search of an ‘Insights-As-A-Service’ provider.

Rocket Mortgage execs share parallel journey at Lendi Group conference

Lendi Group welcomed senior leaders from Rocket Mortgage to headline its Thrive 25 broker conference in Sydney last week.

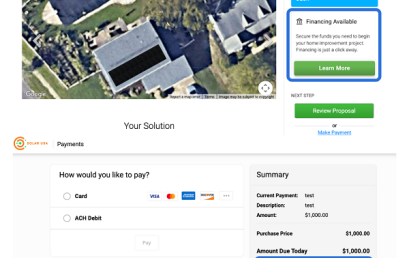

OpenSolar and LoanOptions.ai’s new tech partnership brings instant solar financing to homes across Australia

OpenSolar has partnered with LoanOptions.ai to make home energy upgrades simpler and more accessible for homeowners.

Lendi Group shares bold vision for the future of Aussie business

Lendi Group CEO and Co-Founder David Hyman has shared the company’s bold new vision to transform Aussie from a linear mortgage broking business.

Latest SME Compass report shows inflation, cashflow choking investment in half of Australian businesses

Banjo Loans SME Compass shows SME’s continue to face significant cashflow challenges, with close to half reporting they have delayed strategic investments.

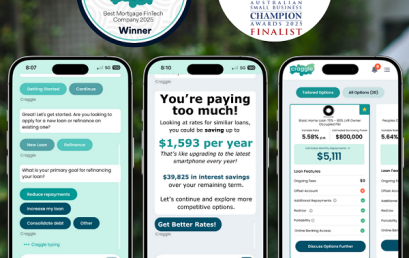

From Fairness to Futurism: How Craggle’s Generative AI is pioneering the next Financial Revolution

Craggle are changing how the world thinks about home lending—by defining a future where everyone gets speed, simplicity and transparency.

Valiant Finance reaches $2.5 billion milestone in business loans

Valiant Finance has hit a significant milestone, facilitating over $2.5 billion in business loans since its conception in 2015.

AI-powered mortgage platform Craggle named Best Mortgage FinTech Company 2025

Craggle has been named Best Mortgage FinTech Company 2025 in the prestigious Australian Enterprise Awards, presented by Corporate Vision.