A record $117 billion in fintech deals have been done this year as cashless payments soar in popularity

Fintech-targeted mergers and acquisitions has increased rapidly over the last five years, and the value of deals in the space has hit a record high in 2019

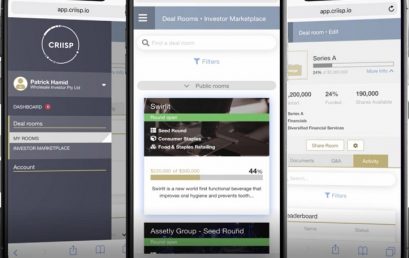

Wholesale Investor launches new end-to-end SaaS capital raising admin platform CRIISP

Australasia’s largest investment platform Wholesale Investor announces the launch of its new SaaS capital raising admin platform CRIISP

Cashwerkz announces partnership with Praemium

Cashwerkz announces its digital cash investment platform is available for thousands of wealth advisers in Australia using the Praemium integrated platform.

Australian FinTech company profile #21 – SelfWealth

SelfWealth empowers investors to build their own wealth via a large Australian investor community and low-fee brokerage.

How Ripple differs from Bitcoin

Have you heard of Ripple? Investors have been doing Ripple trade for almost a year now, but it hasn’t become as well known as Bitcoin yet.

ASIC updates information for businesses on ICOs and crypto-assets

ASIC has released new information to help businesses involved with initial coin offerings (ICOs) and crypto-assets to consider their legal obligations and satisfy themselves they are operating lawfully.

Raiz Invest international expansion continues with JV agreement executed with key Malaysian institution

Raiz Invest has taken a major step forward in its push into Southeast Asia, signing a joint venture agreement with Malaysia’s Jewel Digital Ventures

Bitcoin could surge past $10,000 within 2 weeks, analyst says

Bitcoin could rise above $US10,000 within two weeks, marking its recovery to around half of its record high, according to one analyst.