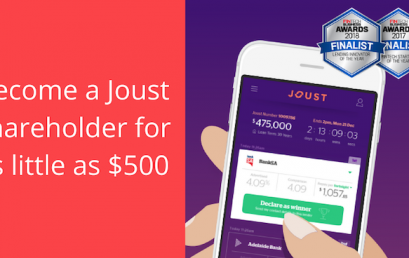

Adelaide fintech startup Joust seeking to raise $2m in Equity Crowd Funding

Adelaide fintech startup Joust is launching an equity crowdfunding campaign via OnMarket and is hoping to raise $2 million to rapidly scale the business. The Joust platform, launched in 2016, links borrowers with more than 20 lenders who compete against each other to offer the lowest interest rate via a reverse auction process. Using equity crowdfunding platform OnMarket, the company plans to spend a large portion of the money raised on advertising, with the remaining funds to go towards product development, potential entry into overseas markets and building out the Joust team. A minimum $700,000 is being sought as part of the capital raise, which allows retail investors to invest between $500 […]

Fintech business lenders sign code to lift transparency

Six fintech start-ups that lend to small business have signed a ”code of lending practice”, a move the small business ombudsman says will improve transparency and protect SMEs by requiring the online lenders to disclose standardised pricing and fairly resolve disputes. Prospa, which pulled an ASX float this month on concerns about its transparency, is a signatory to the code, along with Spotcap, Capify, GetCapital, Moula, OnDeck. They will be compliant by the end of the calendar year. The code will be enforced by an independent committee to be set up by the Australian Finance Industry Association. AFIA has helped write the code, alongside the Australian Small Business and Family […]

What the HODL? Your guide to cryptocurrency slang

Cryptocurrency slang can seem a little bit mystifying to those on the outside, so here’s a useful guide to some of the words you might encounter. Cryptocurrencies such as bitcoin, Ethereum, Ripple and countless others have barely left the news cycle in the last year or so. Bitcoin, arguably the most popular cryptocurrency, hit an all-time high in December 2017 as more and more members of the public jumped on the bandwagon. Digital dictionary What many people don’t know is that there is a rich vocabulary in the world of digital currencies. Forums and subreddits are littered with terminology that can often seem bewildering to outsiders. What are ‘whales’ if […]

AstuteWheel launches new Astute Insurance Planner solution

AstuteWheel has today launched its latest fintech solution, Astute Insurance Planner, which enables advisers to provide better risk advice more efficiently. The solution, which reduces the time taken to prepare risk advice to about an hour integrates three FinTech software systems to provide one seamless solution. It includes an online mini fact-find and risk needs analysis calculator, created by AstuteWheel; a risk research and quoting tool, which is an integrated OmniLife App; and a Workflow, Statement of Advice wizard and CRM provided in Seido. Seido is an integration hub designed by YTML to solve the connectivity challenges advice businesses face when delivering advice. Hans Egger, Managing Director of AstuteWheel, said, […]

Younger advisers drive digital client engagement

Financial planners are increasingly looking for digital means to engage clients, latest Investment Trends research shows. The majority (88%) of advisers are strengthening their client relationships using technology-based solutions to interact and disseminate information, this year’s Planner Technology Report found. The younger generation of planners are driving the digital client experience trend, starting with virtual client meetings. Investment Trends research director Recep Peker said this group expects tablet-enabled client meetings and the use of interactive modelling tools during client meetings to become the norm. Peker added the results provide an opportunity for platforms and planning software providers to collaborate with planners. “Technological advancement is rapidly increasing consumer expectations, a so-called […]

One of the world’s largest crypto-exchanges Huobi Global is coming to Australia

Huobi Global, one of the world’s biggest crypto-exchanges, is preparing to launch in Australia, and Adrian Harrison, chief of the local operation, says the forward-thinking regulatory landscape here puts the country at the forefront of the crypto-movement. Domiciled in Singapore, Huobi provides exchange trading for cryptocurrencies, with 150 coin pairings available. According to Harrison, the exchange is “consistently in the top three in the world, in terms of volumes”. In February, Huobi raised $US300 million ($406.7 million) through the launch of its own Huobi Token, which allows exchange users to benefit from discounts in fees. It launches in Australia on July 5, and will start by listing Australian dollars against […]

Hack warning: Secure your data or risk a $31 million fine

How do you store your customers’ personal data? Are you one hundred percent sure it’s safe from hackers? These are very important questions for small businesses. Just last week Fairfax reported a conveyancing firm’s IT system had been compromised by hackers who were able to steal $250,000 of a client’s funds from it. Plus, stiff new data privacy rules in the European Union last month mean it’s now more important than ever for small businesses to get their cyber security right. Because it’s entirely possible that even though the laws come from the EU, they apply to your business. The General Data Protection Regulation came into force on 25 May. […]

What you need to know about cryptocurrency and tax

The rapid rise of cryptocurrency means many Australians now either invest in bitcoin and other cryptocurrencies or use them as a convenient way to pay for goods and services. But what happens on the tax front when your cryptocurrency portfolio suddenly pays big digital dividends? CoinJar co-founder and CEO Asher Tan explains the key things you need to know. Cryptocurrency use has grown exponentially in the last two years and Australians have embraced cryptocurrencies as a way to spend, send and trade money from anywhere in the world. Today Australia is the world’s 11th biggest market for bitcoin volume. It comes as no surprise, therefore, that governments around the world […]