Spare change investor start-up expands into Thailand and Vietnam

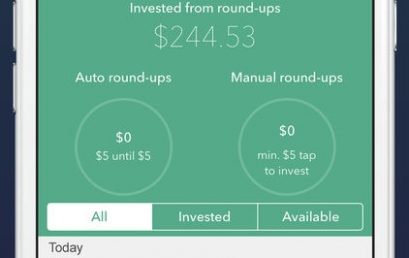

Raiz allows users to round-up everyday purchases and pool their spare change to invest in equities, bonds and other securities.

Australian FinTech company profile #31 – WLTH

WLTH simplifies the way everyday Australians manage their finances, allowing them to track all their assets and liabilities in one simple to use platform.

Jayride integrates with Hyperwallet to drive streamlined payouts and global growth vision

Hyperwallet has announced the successful integration of mass payment distribution for Jayride, the world’s leading online airport transfer marketplace.

Industries leaders express their views on Australia’s open banking regime

Australia’s open banking regime commenced yesterday, 1 July, 2019. Here’s what some of the industry leaders had to say about the launch.

Central banks should issue digital currencies of their own

Because digital money is naturally cross-border, it opens the way to new forms of currency competition, from Libra among others.

FNZ storms into GBST auction with big bid

Private equity-backed global fintech FNZ is the new front marker in the race for Australia’s GBST Holdings with a $3.50 a share indicative offer.

Why Australia can be an open banking leader

The concept of open banking is hardly new because some fintechs have been using account aggregation in their business models for more than a decade.

OpenMarkets releases trading platform for advisers

OpenMarkets Australia has put out a new trading platform aimed at advisers who want fast online tools for trading and investing in Australian securities.