The Finalists of the 2024 Finnies awards have been announced

The finalists for Australia’s 2024 Finnies fintech business awards have been announced.

11th Annual FinTech Summit 2024 sets new benchmark for Australian fintech events

The upcoming 11th Annual FinTech Summit 2024 taps into the exciting high growth fintech and neo banks in Australia.

Bizcap recognised as a leading Australian lender with four Finnies award nominations

Bizcap have been nominated for four Finnies award nominations, including Excellence in Business Lending and Best Workplace Diversity.

Weel strengthens leadership team with new Chief Revenue Officer and Head of Marketing appointments

Weel have announced the appointments of Marten Jagers as Chief Revenue Officer and Nina Putica as Head of Marketing.

Nearly half of SMEs anticipate turnover dip by 2025 as economic pressures bite: Prospa

Prospa reveals that nearly half of SMBs in Australia anticipate a decrease in turnover by the end of the year due to economic pressures.

Credit Clear produces record quarterly revenue of $10.5 million

Credit Clear have delivered record revenue of $10.5 million, up 22% on pcp, tracking in line with guidance of $40 – $42 million for FY24

GoCardless and Intuit QuickBooks integration launched to end late payments for Australian small businesses

GoCardless have announced an integration in Australia with Intuit QuickBooks’ leading financial management software.

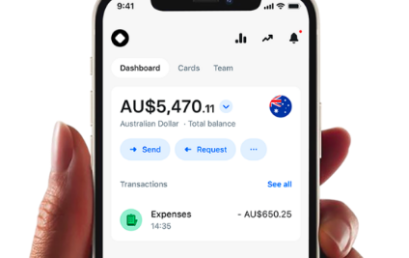

Global fintech Revolut launches Joint Accounts in Australia enabling frictionless joint finance management

Revolut have today announced the launch of its new Joint Accounts product in Australia, enabling two people to share their finances in one single place.