CoinJar exchange lists Zcash (ZEC) offering world first ZEC/AUD order book

CoinJar has expanded its offering by listing Zcash (ZEC) in its portfolio, meaning that for the first time in Australia, cryptocurrency traders and investors will have access to a ZEC/AUD trading pair using an order-book through CoinJar Exchange. Zcash (ZEC) is a leading privacy coin and will be listed alongside Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) and Ripple (XRP). Traders and investors can hedge their ZEC holdings against major fiat pairings including Australian Dollars (AUD), Great British Pounds (GBP), Euros (EUR) and US Dollars (USD) to temporarily protect their portfolio from price fluctuations. CoinJar customers will now be able to send and receive Zcash with their CoinJar wallet, pay bills […]

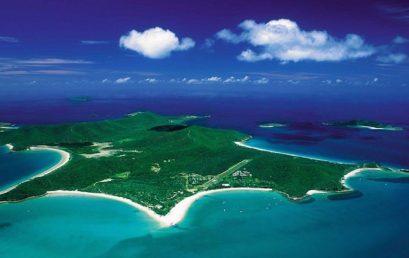

Cryptocurrency behind Great Keppel Island’s $300 million resurrection

There was a time when Great Keppel Island was sold as the ideal place to go and “get wrecked”, a party island at the gateway to the Great Barrier Reef. It then faded into disrepair and then into memory. Now an ambitious cryptocurrency consortium plans to resurrect it as a high-tech wonderland including a luxury resort, private villas and apartments, a golf course, retail outlets and a marina in what is being sold as the world’s largest cryptocurrency-backed property deal. If all goes to plan, they boast, when the development is complete Great Keppel will become the world’s largest island cryptocurrency micro-economy, a project that could bring the new digital […]

Australia to trial a SWIFT-er cross-border payments service

SWIFT, the organization providing messaging and standards frameworks to financial institutions, will start trialing its new real-time cross-border payments service in the Asia Pacific region, initially focusing on inbound payments to Australia. With the new instant global payments innovation (gpi) service, banks can improve customer experience by providing faster P2P remittances and SME trade settlement. The trial will initially include banks from Australia, China, Singapore, and Thailand, using the New Payments Platform (NPP). NPP is Australia’s new real-time payments system which went live earlier this year. Although the trial is currently being run on NPP, the service is designed to scale and integrate with real-time systems around the region. According […]

Why Brisbane is the cryptocurrency capital of the country

Queensland is banking on cryptocurrency to boost tourism in the state, with a sizeable grant given to a Brisbane-based start-up that will enable visitors to pay for every aspect of their travel using digital currencies like Bitcoin. The local start-up, TravelbyBit, has received two rounds of funding from the state government and, in turn, has transformed its hometown of Brisbane into one of the most crypto-friendly cities in the world. TravelbyBit’s digital currency point-of-sale system has been deployed to over 200 merchants across Australia, with at least 60 per cent of those located in Queensland. In May, Brisbane Airport became the first in the world to accept cryptocurrency, enabling travellers […]

Australia just lost one of its most promising fintech startups, Airwallex, to Hong Kong

Tencent-backed payment operator Airwallex has become the latest fintech company to show interest in joining Hong Kong’s virtual banking push. Airwallex co-founder and chief executive Jacky Zhang said the company will team up with a traditional bank and other local partners as part of the application process, although he declined to reveal their identities. “We believe Hong Kong to be an ideal location to be our headquarters. Hong Kong is an international financial centre where we can serve our global clients worldwide,” Zhang said in an interview with the South China Morning Post in his newly installed office in Quarry Bay. Another reason for the relocation to Hong Kong is […]

Could Bitcoin replace Credit Cards?

Growing competition in the retail sector – and the possibility that the digital currency could help merchants lower transaction fees that cut into profit margins — could induce them to replace credit cards with Bitcoin. “From a merchant perspective, Bitcoin has the advantage of not having large fees from credit card companies that cut into profits,” writes Ian DeMartino, in The Bitcoin Guidebook: How To Obtain, Invest, And Spend The World’s First Decentralized Cryptocurrency. “Credit card companies typically charge between three to four percent for each transaction, a fee the merchants normally take on themselves. For merchants with small profit margins, that fee could be up half or more of […]

Aussie Fintech Airwallex founders win Entrepreneur of the Year

The founders of an Australian Fintech company, Airwallex were named Entrepreneur of the Year in the EY South Regional Awards. Founders CEO Jack Zhang and COO Lucy Lui both won the Fintech category and will progress to the nationals where the winners will move on to the international round. The event was hosted by EY and the winners were chosen by an independent panel of prominent business leaders and entrepreneurs. This year, the board acknowledged the entrepreneurial spirit, innovation, financial performance, national and global impact, strategic direction, and integrity of Airwallex founders. To read more, please click on the link below… Source: Aussie Fintech Airwallex Founders Win Entrepreneur of […]

Digital natives love the blockchain because they trust it

The younger ‘digital native’ generation may turn out to be blockchain’s driving force in years to come, as they grow to distrust centralised institutions and systems. That’s according to Dentacoin Foundation’s communications manager Donika Kraeva, who believes that there is a direct correlation between Generation Z’s lack of trust and high adoption of crypto assets and blockchain. Kraeva says that blockchain is a safe, reliable, and efficient way of storing value without any involvement from third parties. Apparently digital natives’ don’t like interference, especially from governments and banks. Digital trust is also more important than ever. Blockchain, Kraeva adds, provides digital scarcity and digital trust worldwide. Blockchain also provides online […]