Australian FinTech company profile #112 – Alex

Alex is a credit-led neobank* aspirant with a goal of making finance faster, simpler and fairer. *They are not a bank yet.

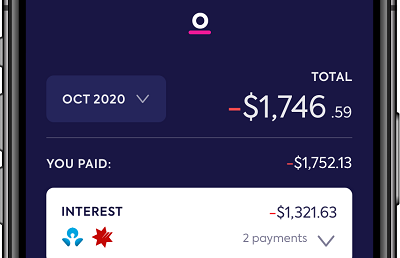

New app launched to help Australians see how much their banking is costing them

The research findings come as Finspo today launches its new app, designed to help Australians find ways to bank better and save.

Conversational Banking: Higher closing rates – seamless communication with customers

CREALOGIX pointed out that financial institutions can use Conversational Banking to communicate digitally with their customers.

Fiserv selected to further Bank of Queensland’s digital strategy

Fiserv has been selected by Bank of Queensland to deliver a card issuing and management solution that can support multiple brands and products.

Bank-backed FinTech platform Lygon is now live

Bank-backed fintech Lygon uses Distributed Ledger technology to transform how businesses obtain, manage and transact on bank guarantees end to end.

SWIFT enables instant 24/7 cross-border payments

This is an important milestone in SWIFT’s strategic ambition to help banks meet growing global demand for instant and frictionless cross-border payments.

86 400 partners with data analytics firm

86 400 has partnered with data analytics firm Envestnet | Yodlee, which will enable the neobank’s customers to see all their accounts in a central location.

humm announces proposed joint venture with neobank Douugh to enter U.S.

Humm announce a proposed joint venture with neobank Douugh to launch a Douugh-branded buy now pay anywhere feature into the U.S market in 1H22.