New app launched to help Australians see how much their banking is costing them

New research has revealed more than half of Australians don’t know how much they pay in interest or fees on their home loans, personal loans, or credit cards each year.

Loyalty to their lender, not having the time, thinking all financial institutions are the same, and believing it’s just “too hard” are the top reasons cited by Australians for not shopping around for a better deal.

The research, conducted by Lonergan Research, found three in ten Australians (30 per cent) don’t think the interest and fees they pay on their financial products are substantial enough to worry about, and 28 per cent of Australians think financial institutions are essentially all the same. Meanwhile, one in five (18 per cent) don’t seek financial products with better rates and lower fees because “it’s too hard”.

This is despite the fact that the difference in interest rates between a new home loan and one taken up four or more years ago is around 0.40% per annum1. On a home loan of $400,000, that equates to around $1,600 extra in interest repayments each year.

“For most Australians with a home loan, banking is their biggest weekly expense. Australians could potentially save thousands each year by banking better,” Finspo CEO, Angus Gilfillan, said.

“The first step is knowing what you’re paying, and what this research tells us is that people simply don’t know.”

The research also found that, despite 73 per cent of Australians believing they’re not getting the best rates from their financial institutions, only one in five Australians (21 per cent) have negotiated or switched for a better home loan rate.

In fact, seven in ten Australians (69 per cent) are more aware of the cost of their utilities bills, than the interest charged on their loans, and five in six Australians (83 per cent) have switched their mobile phone, electricity, internet, or gas provider to save money.

“We’re quicker to shop around for a cheaper mobile phone plan than we are for a lower home loan rate – even though the potential savings are much greater,” Gilfillan said.

“What’s staggering is the difference between what people think their banking costs, and what it actually costs. Finspo research showed that the average amount spent by Australians on their banking was $9,5002, but, when asked about it, people tend to not know or significantly underestimate this number.”

“Not knowing what their banking costs also means Australians don’t know how much they could save,” Gilfillan said.

The main reasons Australians give for not knowing how much their banking costs are because interest rates and fees are not shown clearly on their statements, and they’re automatically charged.

Five in six Australians (83 per cent) think their financial institution should be more transparent around the interest and fees they charge.

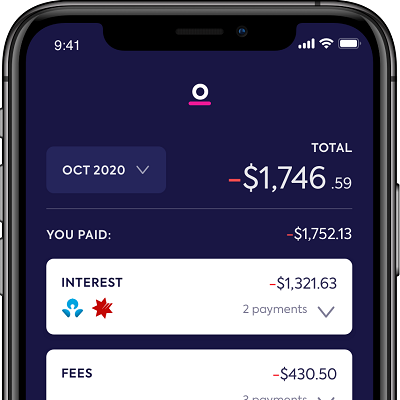

The research findings come as Finspo today launches its new app, designed to help Australians find ways to bank better and save.

The Finspo app is available for free download on the App Store and on Google Play, and provides:

- An overview of the true cost of a user’s banking across multiple products and providers;

- Personalised insights on where users could save; and

- Easy to follow actions to save on your banking, including how to get a better home loan rate.

“Many Australians have accounts, loans and credit cards with different banks and lenders – which means they don’t have a consolidated view of their banking. Through Finspo, users can link their accounts in one place and get a much clearer picture of their banking, and receive smart insights to help them save,” Gilfillan said.

“Amazingly, more than two thirds of Australians (71 per cent) don’t actively manage their funds to reduce fees and interest payments – for example, nearly half of Australians (46 per cent) like to have savings, even if it means they don’t pay off all of their credit card debts each month.”

“When you consider that credit card interest is around 21 per cent per annum, that’s a lot of money to be paying in interest when you’ve got the available funds in a savings account … especially when savings accounts earn very little interest. Our insights will show people how they can save,” Gilfillan said.

Earlier this year, Finspo launched one of its key features, rate my rate, a home loan comparison tool, and Finspo has recently appointed Australian Finance Group (AFG) to be the aggregator of its mortgage broking offering.

“We encourage users to use rate my rate and see how their mortgage stacks up – and, when they’re ready to look around for a better deal, our partnership with AFG means we can give our customers access to a wide range of lenders, and to a team of experts who can help them through the process.”

“With interest rates at record low levels, now is absolutely the time for Australians to look for a better deal on their home loans,” Gilfillan said.

1 RBA Statement on Monetary Policy – February 2020

2 Based on the average fees and interest paid by a sample of Australian households over a 12-month period as per Finspo research conducted in early 2020.