Calastone records largest ever outflows from Australian funds as investors react to COVID-19

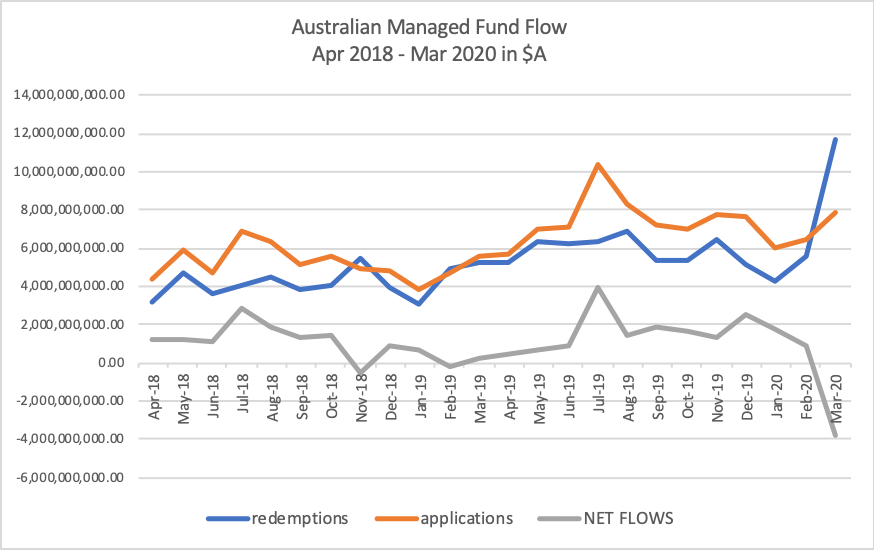

Calastone, the largest global funds network, has revealed the extent to which Australia’s managed funds sector has been impacted by fears and uncertainty around COVID-19, with the largest ever net outflow of almost A$4 billion leaving Australian Funds in March 2020.

Over A$11.8 billion flowed out of Australian funds during March, the sharpest redemptions surge ever recorded across the Calastone network in Australia. This was cushioned by strong inflows of A$8 billion as investors variously responded to the gravity of COVID-19, resulting in net outflows of more than A$3.8 billion*.

The fund flows in Australia were largely in line with international markets in March, with Hong Kong recording net outflows of A$2.7 billion and A$7.3 billion leaving the UK, however the drop was more pronounced in Australia. Flows were mostly from bond funds, as was the case in Asia and Europe where political uncertainty produced more volatility throughout 2019 relative to Australia.

Commenting on the fund flows, Ross Fox, Managing Director, Head of Australia and New Zealand at Calastone, said, “the magnitude of redemptions in March illustrates the effect COVID-19 is having on investment momentum in Australia, where aside from modest volatility events, the market has seen month-on-month net inflows over a long period of time.”

While many investors elected to add to portfolios in March, with the ASX 200 bouncing around in a range of 25-30% below its February peak and long term interest rates at historical lows, the impact for the funds management sector has been more acute as investor redemptions compound the effects of market downgrades and reduced asset bases.

The data showed November 2018 to be the only other month to experience material net outflows, which coincided with a period of volatility in local and global equity markets. There was a modest outflow in February 2019, at which time the market was digesting the Royal Commission’s findings. Net inflow spikes were also observed around the end of tax year in July and August when portfolios typically rebalance.

Mr Fox said that redemptions narrowly outweighed applications so far in April, which is a positive turnaround.

He credited the industry for its agility in handling the recent pressures, adding, “the heightened activity that we have seen across our funds network at a time when most people are working from home is a testament to how well the sector has embraced technology and automation to solve pain points, whether they are legacy or new ones such as we are experiencing with COVID-19.”

Notes

*The fund flow data are based on the applications and redemptions across the Calastone network for Australia based fund managers over the last 24 months. Calastone automates fund transactions for 95% of Australian platforms and 75% of fund managers in Australia. The network has processed over A$210 billion in transaction value for more than 1,400 individual Australian funds over the last two years.