A record $117 billion in fintech deals have been done this year as cashless payments soar in popularity

Fintech-targeted mergers and acquisitions has increased rapidly over the last five years, and the value of deals in the space has hit a record high in 2019

Afterpay, Zip propping up sluggish retail sales

In the six months to December 2018, listed buy-now, pay-later providers Afterpay and Zip accounted for about 16% of the growth in retail spending.

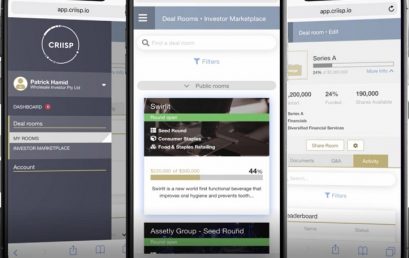

Wholesale Investor launches new end-to-end SaaS capital raising admin platform CRIISP

Australasia’s largest investment platform Wholesale Investor announces the launch of its new SaaS capital raising admin platform CRIISP

Cashwerkz announces partnership with Praemium

Cashwerkz announces its digital cash investment platform is available for thousands of wealth advisers in Australia using the Praemium integrated platform.

Verrency reaches a milestone with over 30 strategic partners

Verrency has secured 32 strategic partners to leverage the company’s enterprise grade, curated API capabilities at financial institutions.

Irish regtech Priviti and Australian fintech Accurassi announce partnership

Priviti, a global fintech and regtech company has announced a partnership agreement with Australian fintech company Accurassi

Australian FinTech company profile #21 – SelfWealth

SelfWealth empowers investors to build their own wealth via a large Australian investor community and low-fee brokerage.

30,000 reasons for SMEs to act fast

OnDeck Australia is urging SMEs to act fast to secure finance ahead of 30 June 2019 to take advantage of the $30,000 instant asset write-off.