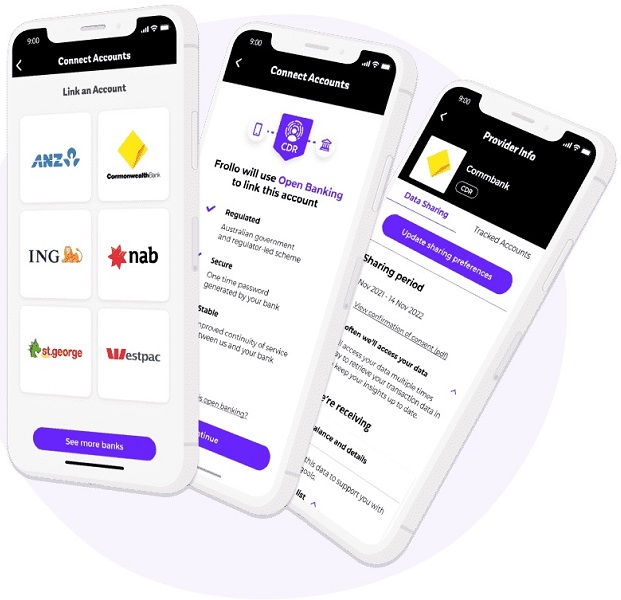

Australia’s most popular money management app phases out screen scraping in favour of Open Banking

Australian Open Banking provider Frollo has announced that it’s phasing out screen scraping in its free money management app, where Open Banking is available. It has already disabled screen scraping for ANZ, CommBank, NAB and Westpac and is planning to do the same for at least 50 other banks before the end of 2022.

The company says improved security, user control and access to real-time transaction data make Open Banking a superior alternative to screen scraping. In addition, the Big Four banks now support data sharing for over 30 different product types via Open Banking, providing the coverage required to operate a successful personal finance management app.

Frollo CEO Tony Thrassis said, “Phasing out screen-scraping is about much more than just the user experience in our app. It’s the start of a new era where consumers are in control of their own data, they can share it securely and their privacy is protected.

The fact that we’re now able to deliver a superior user experience by relying solely on Open Banking for a number of products and providers is an important milestone for the Consumer Data Right (CDR).

Already, more than 8 out of 10 new accounts linked in the Frollo app are using Open Banking, and we expect this to only increase as we progressively phase out screen scraping for other banks until it’s only used for banks and products not covered under the CDR.”

The advantages of API-powered Open Banking were highlighted recently when NAB announced it is implementing increased security measures for online banking. These changes will protect from fraud and as a consequence limit screen scraping for practical use.

By mid/late August, the bank will require customers to use multifactor authentication (MFA) when they log in. This will likely result in users of screen scraping-based apps having to input a new MFA code every time they want their app to update.

And they’re not the first bank to do this. HSBC has long been unavailable through screen scraping, and Macquarie Bank recently implemented security improvements to a similar effect as NAB’s.

The importance of changing the default

Thrassis added, “Our research shows that consumers care a lot about their privacy and security when sharing financial information. Yet, many consumers share their banking ID and password with third parties to get access to products and services. Most consumers probably don’t even know who gets access to their credentials nor think about what they could do with that type of unrestricted access.

“It’s a familiar paradox also seen in other industries, with one big difference: Finance now has an alternative.

“It’s important to change the default, as soon as we can. And we’re starting today.”