AI adoption is critical but must remain the co-pilot in customer service: Lendi Group

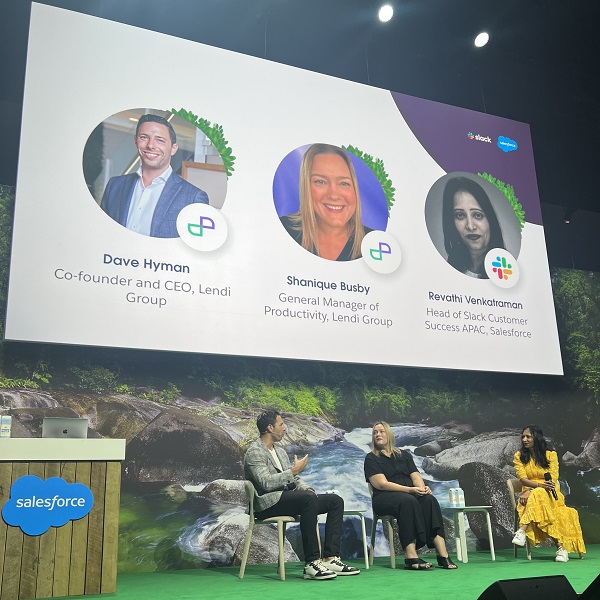

Lendi Group is placing itself at the forefront of innovation, actively shaping the future of work in the Group’s workplace. Speaking at the Salesforce World Tour this week in Sydney, Lendi Group Co-Founder and CEO Dave Hyman showcased how Lendi Group is implementing transformative technologies to revolutionise the 1000’s of hours of administrative tasks by brokers and vastly improve on customer experience for mortgage lending.

Key highlights included Lendi Group’s commitment to innovation with the company leveraging Artificial Technology (AI) to enhance external processes, providing homeowners with a more efficient experience and ensuring a seamless journey for customers, in line with Lendi Group’s mission to transform the journey of financing a property into a friction-free experience.

Lendi Group has began rolling out the first of two AI initiatives this year, a powered broker assistant for brokers, that summarises broker and customer interactions, and is set to save brokers 1000’s of hours annually, and a second AI powered broker assistant bot that will fast track broker’s policy related queries from across 2500 products within the Group’s platform.

“Emerging from a company-wide and broker ‘hack-a-thon’ last year, it became clear the biggest problems we could use generative AI to solve for brokers was finding a solution to the 30 minutes for every customer interaction that takes place drafting post-call summaries, and a further 30 minutes for every customer researching lending policies and the right data sources to answer customer queries.

“As a business focussed on growth, we see these efficiencies as creating more capacity for our business, allowing us to serve more customers on their home loan journey. Our conservative estimate of these AI tools once productionised is 8.6k hours of associates time and 44.8k hours of broker time, amounting to multi-million dollar operational savings, annually.

“By using OCR (Optical Character Recognition) technology, we can implement automatic information extraction from customer’s uploaded documents, such as identity documents, payslips, bank statements, etc. This will help pre-fill and QA information to expedite application process.”

Shanique Busby General Manager of Productivity at Lendi Group, said, “As a product led organisation, that supports our brokers to connect with customers for one of the biggest and most important decisions they make in their lifetime (their home and mortgage) – our next journey with AI is to continue building on the foundation architecture for boosting future AI tool development capabilities within Lendi, that use AI as a co-pilot to helping our brokers have better outcomes.

“This is just the start, but we remain focussed on building foundation architecture for boosting future AI tool development capabilities, that use AI to help our brokers have better outcomes.”

Peter Doolan, Slack Chief Customer Officer at Salesforce, also on the panel with Dave Hyman, emphasised the importance of considering the human aspect in AI adoption, stating, “Populations and large groups of people have usually very fixed expectations around what they consider normal, and it takes something really, really big to change that. I think we are seeing that change happening now with AI.

“And all these AI technologies ultimately come into contact with humans. It is us, the human workers, that have the responsibility to make the AI come to life, to make it real for our place of work, our home life or wherever it may be.”