Introducing Australian FinTech’s newest Member – Clear Dynamics

Clear Dynamics creates better software applications faster. By leveraging the power of AI driven automation, they breathe new life into old systems.

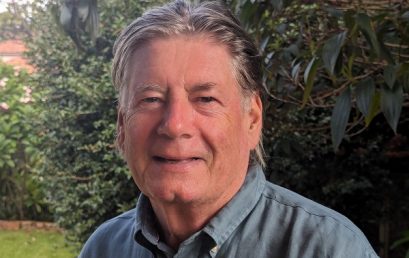

Victorian AI scale-up Clear Dynamics appoints veteran Gartner analyst Neil McMurchy to Board of Directors

Clear Dynamics, the Australian AI scale-up breathing new life into legacy systems, have today announced the appointment Neil McMurchy to its Board of Directors.

Australian FinTech company profile #116 – Clear Dynamics

Clear Dynamics’ mission is to free businesses from fixed system constraints and complexity, so they can focus on their growth rather than their technology.

Good news for Australian fintech startups – OIF Ventures raises oversubscribed $140m VC fund

Leading Australian venture capital firm OIF Ventures has announced the successful closing of OIF Ventures Fund III at $140 million.

Calastone research reveals tokenisation could save US$135 billion for asset management industry

Calastone has today released groundbreaking research, revealing that tokenisation holds the potential to unlock over US$135 billion in cost savings for the asset management industry.

DTCC Executives comment on the year ahead

Several key executives from The Depository Trust & Clearing Corporation (DTCC) have outlined their views for the year ahead.

Australian and New Zealand banks embrace AI to stay competitive in a rapidly evolving market

The financial services industry in Australia and New Zealand is undergoing a seismic shift, with Artificial Intelligence (AI) at the core of the transformation.