Credit Clear achieves EBITDA of $0.2m, revenue of $8.6m up 41% PCP, $3.2m in potential revenue added, a big four bank signed post quarter end

Australian technology and debt collection provider Credit Clear Limited (ASX: CCR) has announced that in Q3 FY23 the Company recorded $8.6m in revenue, up 41% PCP, and signed 89 new clients, adding an expected $3.2m in Potential Revenue. Post quarter end the Company has signed a big four Australian bank which is not included in the Potential Revenue for Q3.

The addition of a big four bank highlights Credit Clear’s growing position as provider of choice to Tier-1 companies in Australia, where in the past four months the Company has signed multiple Tier-1 clients across insurance (IAG), local government (a large Victorian council), and consumer divisions (big four bank, QUU and TAFE NSW).

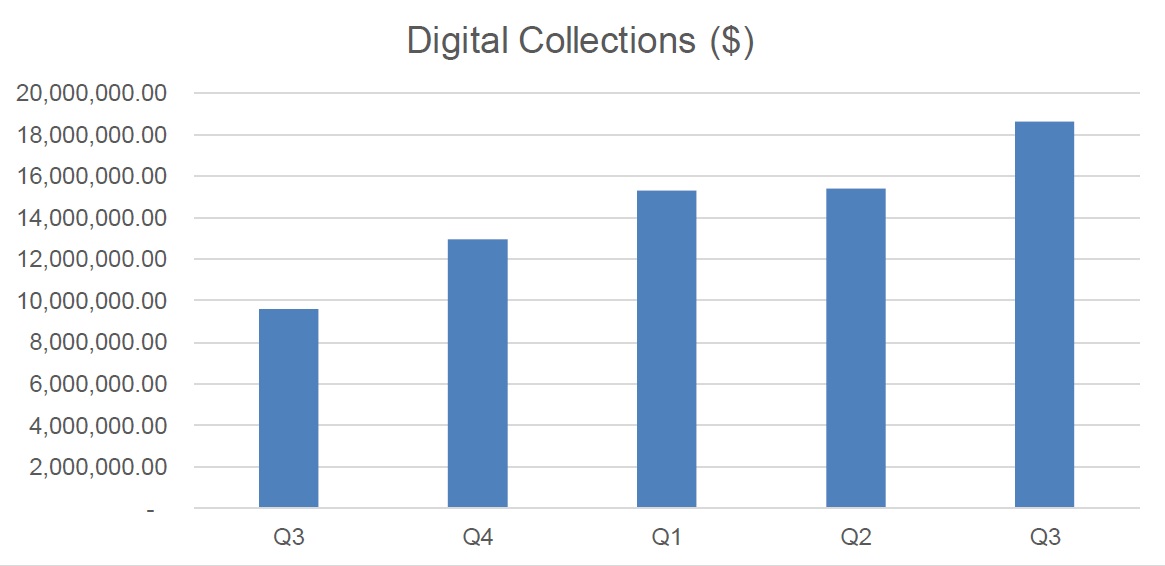

Payments collected via the digital platform continue to show strong growth with a record quarter of $18.6m in transactions processed, up 94% PCP and 21% QoQ. Growth in digital collections is a direct result of ARMA’s digitally led hybrid approach where Credit Clear’s technology is driving customer engagement in preferred channels where the best chances of conversion exist.

Active Files, a key metric and leading indicator of future revenue, is up 52% PCP and 17% QoQ to 1.1m, surpassing one million files for the first time. The value of files under collection is $1.49bn, a new key metric reported by the Company.

New clients include:

- IAG, one of the largest general insurance companies in Australia and New Zealand, to deploy its purpose-built digital workflow for third-party motor insurance claims, enabling third parties to pay online. By signing the insurer, Credit Clear increases its penetration into the Australian general insurance claims market, where the Company believes its digital insurance claims workflow has the potential to become the de facto platform for third-party motor claims processing.

- Two clients that purchase debt, where the Company is engaged directly by these clients to improve engagement, collection rates and customer experience.

- TAFE NSW, the largest single provider of vocational education and training in Australia, has engaged ARMA to manage all arrears payment plans for their domestic and international students. ARMA was successful in winning back this business after the contract was taken inhouse in July 2022. In bringing back ARMA, TAFE NSW noted that ARMA had been more effective in managing the process, delivering a superior solution, financial outcome and improved student experience.

- A large Victorian council has appointed Credit Clear to work across its significant portfolio of ratepayers in arrears. The new Victorian council is seen as a progressive benchmark in Victoria, where a successful deployment will likely be emulated across other councils.

Industry outlook

The total addressable market for debt under collections in Australia in December 2022 was estimated to be $20.8bn according to the ACDBA4. At the end of March 2023, Credit Clear’s value of files under collection was $1.49bn, or 7% of total debt under collections in Australia. The Company’s own data (reflected in the tables below) shows that this could be substantially higher in 2023 given the increased collection activity on debt accumulated over the COVID years, as well as new financial pressure on consumers, due to higher interest rates and general inflation, which is compounding the growth in debt under collections.

Debt files referred to ARMA’s consumer collections team provide a clear indication that over and above new clients signed and winning additional work from existing clients, the value of debt under collections is rising rapidly across the economy. The number of files referred to ARMA’s consumer team in the past 12 months has grown 85%, the value of these files is up 211% and the average debt per file has increased 69% from $589 to $997 per file.

| Number of Files Referred | Value of Files Referred | Average Debt Per File | |||

| Q3 FY22 | 62,886 | $37,063,846 | $589 | ||

| Q3 FY23 | 115,356 | $114,970,101 | $997 | ||

| Percentage change | 85% | 211% | 69% | ||

Credit Clear has previously emphasised that a more challenging economic environment, where a significantly larger portion of the population is likely to experience some financial vulnerability and be required to make budgetary adjustments, will highlight the need for its digitally led hybrid offering to prospective Tier-1 clients, including several marquee clients in the insurance and banking sectors.

In the year to date the Company has signed an Australian big four bank, one of the Australia’s largest insurance companies and several large consumer organisations clearly marking the Company’s status as an emerging provider to some of Australia’s largest companies.

The Company continues to focus on new clients that have been signed and onboarded during FY23 to work towards shortening the time to achieve the expected annual revenue potential. As previously communicated, that due to client-side processes, a typical large client once signed can take between one to three months to onboard and, then take six to twelve months to scale up to potential revenue expectations. Therefore, much of the significant new business signed in FY23 is still climbing towards anticipated Potential Revenue.

Digital collections

Digital collections in Q3 set another record, collecting $18.6m in digital payments, a 94% increase on PCP and 21% QoQ.

Case study (content and presentation)

The Company continues to accumulate data validation points of the effectiveness of its digital messaging, with a 48% increase in collections for a major healthcare provider. The ‘Champion/Challenger’ case study, which was run over a 28-day period, showed that changes made by Credit Clear to the content and presentation of the digital messaging driven by the Company’s unique AI, additionally delivered a 14% increase in customer engagement and an 18% increase in the conversion rate. The success of the content changes was particularly evident at the higher debt bands above $500.

Content and presentation of digital messages

| Collections: | Up 48% |

| Engagement rate: | Up 14% |

| Conversion rate: | Up 18% |

| Debt band: | Highest increase in collections for debts over $500 |

Cash flow and profitability

The Company achieved a $0.2m EBIDTA1 in Q3 on an underlying operational basis. Cash and cash equivalents at the end of the quarter stood at $5.0m, down from $9.3m in the previous quarter. $3.6m of outgoing cash is classified as operating cashflow, including the one off $3m cash component of the earnout from the ARMA acquisition which was paid along with $0.7m in annual prepayments.

Payments to related parties of the entity and their associates detailed in Section 6 of the Appendix 4C relate to directors’ fees paid during the quarter including the CEO’s salary and $1.4m that was paid as part of an acquisition earn-out to an executive director who was a previous part owner of the acquired business. This is a one-off payment which is in accordance with the purchase agreement.