Young savers flock to new wave of neobanks

Young savers are clambering aboard a new wave of digital banks that are setting their sights on taking a significant chunk of market share from the traditional big-four banks.

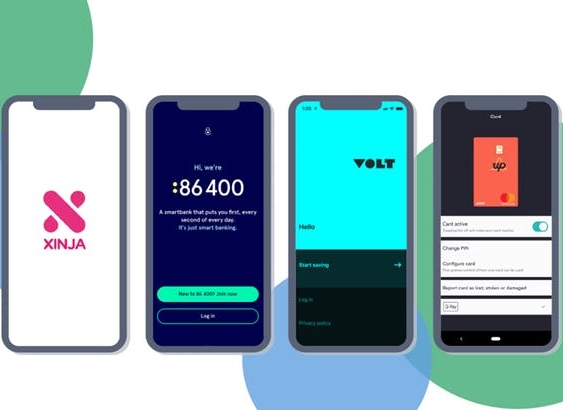

More than half a billion dollars in deposits have flowed into online neobanks such as Volt, Xinja, Up and 86 400 in recent times.

The digital upstarts attract the younger crowd with offerings that include quick online sign-ups, digital payments, recurring bill reminders, grouped transactions and even budgeting tools, so you can track how much you are spending. Bank 86 400 will soon start analysing electricity bills and recommend savings options, too.

The young favour neobanks for convenience, according to Rebecca Schot-Guppy, general manager of FinTech Australia.

“They’re also extremely credit savvy and have a willingness to pay for items through ‘buy now pay later’ services, which have often been integrated into these products, while also providing them valuable insights into their spending habits,” she says.

Neobank Up says more than half of its 165,000 customers are aged between 16 and 24 and its account balances currently stand at $172 million, up more than 400 per cent in the past year.

The young are “app connoisseurs” who able to quickly separate well designed apps from those that aren’t, says Up’s head of product Anson Parker. “They expect more from their apps and aren’t afraid to try something new.”

“We’ve made saving less onerous and boring, using fun features like ‘pull-to-save’ by making it possible to round-up your spare change or automatically set up pay-splitting,” he says.

To read more, please click on the link below…