Winklevoss twins and global decacorn invest in Volopay’s $29M Series A

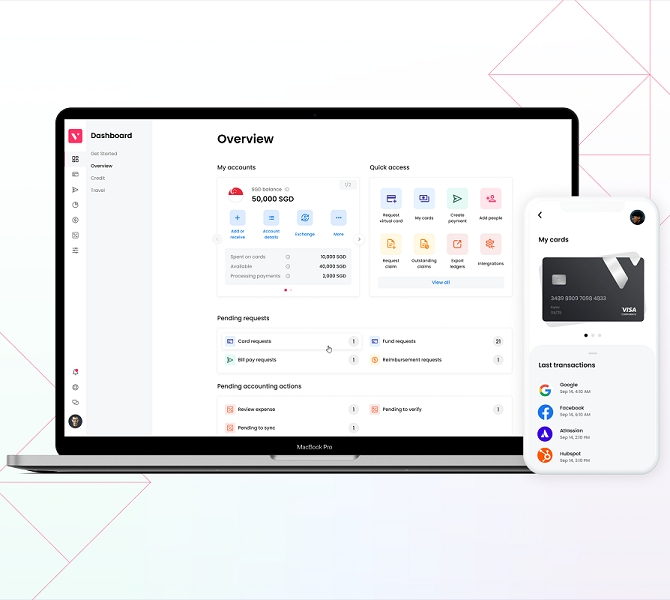

Contrary to popular belief, the way businesses manage their money is broken. With no clear view of their financial health, it is essential to implement order via modernization, automation, and enhancement of existing workflows and processes providing synchronal visibility. Volopay, a Y Combinator-backed Singapore-based corporate cards, and payable management startup are poised to tackle and fix this problem.

Having raised $29 million in Series A, a mix of equity and debt, Volopay is all set to expand to APAC and MENA markets.

The round included participation from JAM Fund, Winklevoss Capital Management, Accial Capital, Rapyd Ventures, Fintech veteran Jeffrey Cruttenden – Founder of Acorns along with Access Ventures, Antler Global, and VentureSouq.

Justin Mateen, founder of Tinder and JAM Fund who led the round, said in a statement, “I’ve worked closely with Volopay’s amazing team since my original investment at the pre-seed stage. Given the accelerating growth of the business, and the team’s ability to innovate quickly on the product side with a single stack scalable platform across multiple jurisdictions, it was only natural to triple down and lead the Series A round. I am proud to partner with a leader in this space and to help support Volopay to scale to greater heights”.

With Volopay firmly placing itself into the Australian and Singaporean markets, it now eyes on the entire APAC region along with the MENA expansion on the horizon.

The highly anticipated launch into multiple markets is crucial since the growth prospects are immense. “With APAC & MENA churning out several unicorn level enterprises every year, it is indeed making a big wave on the global frontier. And this is only the beginning. Accelerating their growth would require an efficient expense management tool that is simple yet scalable, something that Volopay has always aimed for,” said Rajith Shaji and Rajesh Raikwar, Co-Founders of Volopay.

The profound disconnect between the finance and business operations of most organisations is a major challenge. Volopay focuses on building processes essential to enhance the coaction of these two functions. Bringing these two silos together under a single roof, the system will naturally help businesses save time and money so they get to focus on more pressing matters. The integration and automation of a seamless FinOps function give Volopay a significant competitive edge.

Rajith said, “Volopay is an ambitious project. To build an alternative to Volopay, you’d have to launch 5 different startups. We are building the control centre for modern companies for all their financial management needs. Our platform is as easy and seamless to use for a 5-person company, as it is for a 500-person company. We want to take our vision of a unified spend management platform to all companies across the world after our initial markets of APAC and MENA.”

Volopay’s mission is not to simply build a business. What they are doing is pushing change in every market they step foot in, changing the way businesses handle, manage and have control over their money.

Volopay is disrupting traditional business banking and aims to be adopted as the single and only solution growing, global businesses need for their cards, invoice automation, and bill payments along with the added bonus of a multi-currency business account without the hassle and limitations of a traditional bank.

To achieve this, Volopay has embarked on the ambitious objective of building its own infrastructure and applying for financial licenses in its markets.

Rajith said, “Many of our competitors around the world will opt to integrate with 3rd-party infrastructure suppliers to provide financial services. This limits the type of products you can offer clients, and with each region playing host to its own network providers, it is almost impossible to deliver a consistent and delightful customer experience for our global company clients operating in different parts of the world. We are doing something no other company has done regionally, we are building our own infrastructure. Not being held back by the limitations of an intermediary, this foundation will not only let us create highly innovative financial products, but also a pleasant and reliable customer experience across all our markets.”

Since its seed funding, Volopay has grown exponentially to better alleviate its clients’ pain points. With a 150+ member team spread all over major business centres in the Asia Pacific region, such as Singapore, Australia, India, Indonesia, and the Philippines, Volopay has amassed an impressive clientele with the likes of Deputy, m-View, and Code Camp among others.

However, more work remains to be done in this industry, says Rajith. One of the most pressing problems that SMEs and startups face today is the high FX charges incurred for international payments and the lack of a uniform platform available to access all spend data.

Volopay’s foray into the APAC and MENA markets is to tackle precisely the problem stated above by providing companies with multi-currency wallets to hold money in their base currency and any major currency – USD, AUD, EUR, GBP – and subsequently use it for payouts. This will help completely eliminate exorbitant amounts of FX charges levied on international payments.

“We provide growing businesses, startups, and enterprises flexibility and a premium experience by issuing cards and processing money transfers – domestic and international. And in the case of a multinational company with entities spread across the globe, Volopay provides a single go-to-platform for everything money and finance to stay connected and up to date across their global locations and teams,” said Rajith.

Part of Volopay’s Series A funds will be put towards their forthcoming market launches, building and innovating new technologies to complement their existing product.

The company will be investing in enhancing its integrations with popular ERPs, HRMs, and CRM software along with leading project management applications. The company is also hiring aggressively for key positions in each of its markets.

Michael Shum, Chief Investment Officer at Accial Capital said, “Accial Capital views the B2B corporate spend vertical as a way to support entrepreneurs and SMEs with liquidity and close the credit gap. Volopay has a great ambitious team focused on redlining the finance workflows with its robust technology. We are proud to partner with a leader in this space to help scale.”