What’s next for the Consumer Data Right?

By Frollo.

In the State of Open Banking 2023, we take a pulse check of the industry and the opportunities it presents for banks, fintechs, brokers and lenders. In this article, we investigate what the future of the Consumer Data Right holds for consumers and businesses.

Australia’s Consumer Data Right (CDR) was always planned to be an economy-wide reform, rolled out sector by sector – with banking being the first. As the Open Banking system that CDR brought us reaches a level of maturity, many eyes are now focused on the next sector to face changes to their data regulation landscape – energy.

But that doesn’t mean there’s not more to come in the banking space. Treasury is developing new rules to empower customers to use their data in new ways. And the CDR will expand to include the broader finance industry, such as non-bank lending, insurance, superannuation and payments data.

The continuing CDR roll-out presents enormous opportunities for innovation, not only within sectors but also across industries where shared data rights can combine to provide real value for the consumer.

Action Initiation

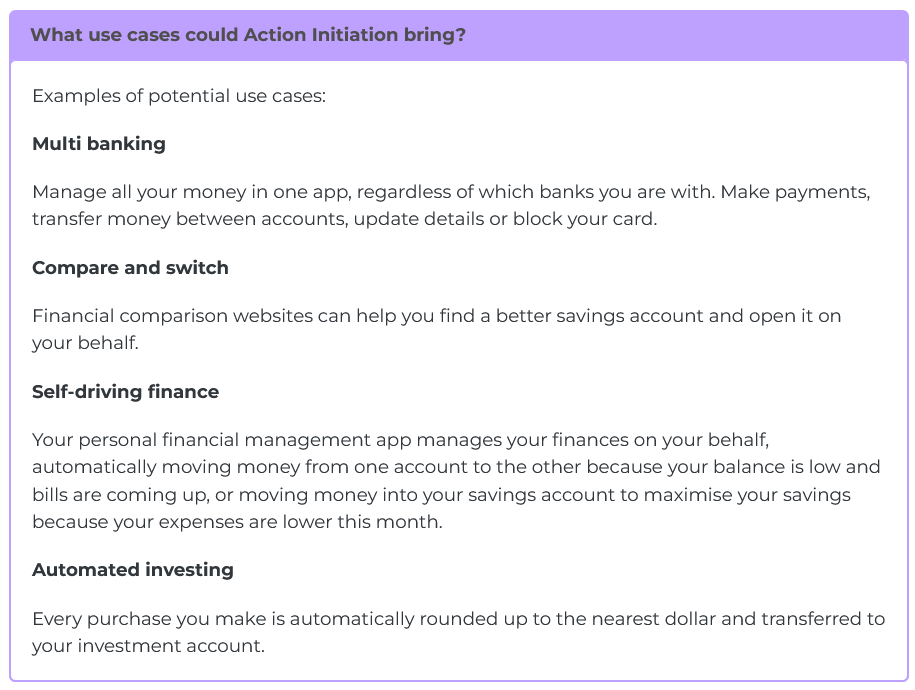

Action Initiation is the most anticipated Open Banking expansion in Australia – and with good reason. It will create a new channel for consumers to instruct a business to act on their behalf (with their consent). These actions could include:

- making a payment (such as through NPP/Pay to)

- opening and closing an account

- switching providers

- applying for services

- updating personal details (such as address) across providers.

Action Initiation in the CDR – as per draft legislation

It’s still early days for Action Initiation, as it requires legislation to be passed in parliament and rules to be developed. Draft legislation was published by Treasury on 26 September 2022, so Action Initiation will likely not launch in Australia before 2024. But when it is up and running, it has the power to disrupt how consumers can use their data.

We’ve seen it have a significant impact in the UK. At the end of 2021, 26 million open banking payments had been made, with payments increasing more than 500% in a year.

Open Finance

With more than 100 banks sharing data via Open Banking, coverage of the sector is sound. Yet, a consumer’s financial information isn’t limited to banking, meaning some gaps still need to be filled. Enter Open Finance.

The Government is currently moving towards a phased rollout of the CDR across the broader financial sector, including non-bank lending, merchant acquiring services, and key datasets in the general insurance and superannuation sectors.

To read more, please click on the link below…

Source: What’s next for the Consumer Data Right? – State of Open Banking 2023