What does a great broker journey look like for financial institutions? Automated solutions, greater efficiency

On average, brokers account for 70% of home loan applications according to recent data reported by the Mortgage & Finance Association of Australia. Like Financial Institutions (FIs), brokers have to contend with numerous obstacles in the application process. Adopting a solution that automates crucial parts of the process can be an efficiency win not just for the FI and its staff, but for brokers too.

Rising interest rates and cost-of-living increases, combined with fixed interest periods coming to a close, are putting many customers under mortgage stress. In this environment, it’s no wonder property owners are looking to switch, chasing a better rate with their lenders and brokers.

Many customers also view the mortgage process as a complex one, and the broker is perceived to be the route to securing them the best deal with the least stress. Brokers have connections with multiple lenders, they can assist borrowers with documents, information gathering and advice: they become the go-to source.

Brokers under the pump

The pressure is on brokers to obtain better deals for an increasing volume of customers. But they have a competing priority: their need to retain their customer base. Every time one of their existing customers switches to another broker and/or FI, the broker potentially loses a trailing commission.

There’s also the burden of maintaining the quality of data they supply to FIs as part of the application process. FIs expect good quality documents and proposals, and brokers must submit deals in line with the FI’s known requirements, so the FI can turn them around faster.

It can be complicated and there’s a lot of data entry involved as brokers deal with multiple financial institutions, each with different policies and checklists to satisfy. Brokers must work with a variety of systems, from their own in-house spreadsheets and back-ends which are often pulling in data from their aggregator, to the portal they use to interact with the FI.

Bearing in mind that broker businesses are dealing with talent shortfalls, like most organisations, there can be gaps in the streamlining of that process. What brokers need are ways to make their work more efficient, and a better experience overall.

The position financial institutions are in

From the financial institutions’ perspective, they see the broker percentage of loans increasing across the board. They understand their pressures; they know they must service this channel efficiently, make the process smoother for brokers, and improve their journey.

It’s obviously in the FI’s interest to close the gaps in the application process. When brokers don’t supply all the information and data required in an application, it takes time to go back and retrieve the missing information from customers.

Financial institutions don’t want to negatively impact customers with poor turnaround times, and they don’t want to get a reputation for delayed approvals. Nor do they want to employ teams specifically for the re-work and clean-up required to get deals ready for assessment.

They too, are eager to make processes more efficient.

Continuous improvements to achieve greater efficiency

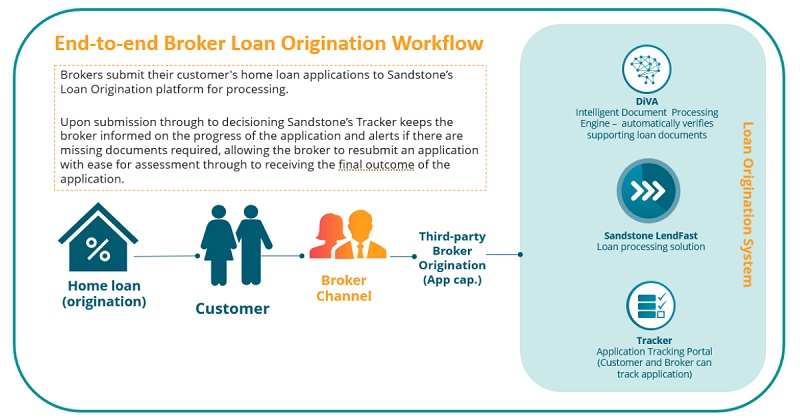

Sandstone Technology understands the pain points for the broker and third-party channel. This awareness drives the continuous development in our solutions aimed at helping financial institutions and brokers manage their processes more efficiently.

The Broker Submit feature within our loan origination solution helps FIs provide a seamless broker experience. After the initial application submission has been passed through the FI’s broker portal, it then becomes part of Sandstone’s loan origination solution.

Importantly, this means the broker gets an immediate, upfront response alerting them to any missing data or documents, removing the time gap between submission and response. Back-channel messages update brokers on how the deal is progressing, any rules which have failed and why, and outstanding conditions or checklists.

With Broker Submit, the financial institution can also provide LMI updates and valuation status updates in the messaging, as required.

Another bonus: there are minimal touchpoints in the Sandstone loan origination solution. Back end staff don’t need to be monitoring the application data or looking into the deal, and manually contacting the broker to alert them to missing items. And there’s no need for the broker to chase the bank for updates. It’s all automated in the system.

No need for full re-submission either

If there is re-work required after the initial submission, the broker will have the option to resubmit their existing deal without having to start the entire process from scratch, using a separate system or module. They don’t have to provide data on a different channel outside the one they’re already working in – they can update information or upload documents direct to the financial institution via Sandstone’s Tracker.

Not only does that save the broker time, but with the broker having full transparency over the progress of the application, and enabled to do updates and re-submissions at their end, it means less re-work for the FI. One of Sandstone’s customers saw a reduction of 80% in reviewing declined applications.

The high configurability of Sandstone’s loan origination system allows FIs to self-serve and manage their workflows and rules themselves. They can define different workflows, tasks, checklists and credit rules for applications coming through different channels to respond to changing marketing demand as required. It’s also far easier for institutions to manage their broker channel and the applications. They can improve turnaround times for deals and give proper feedback to brokers throughout the process.

When it comes to the financial institution/broker relationship, Sandstone has a dual role – to enhance the process for lenders, whether through direct digital channels or through a branch, and put the technology in place to improve the broker experience. We’re always working to improve and automate our straight-through processes which ultimately support all channels.