Upworth launches its Australia wide Savings Account Scanner

How to practically and time-efficiently make sense of the complexity of Savings Accounts products in Australia? How to stay on top of the latest conditions and be sure to take advantage of the best offers? How to find an unbiased source of information? That’s why Upworth developed their Savings Account Scanner. In fact, the Australian Competition and Consumer Commission formulated a number of recommendations to improve our lives as customers. Their recommendations were so good that Upworth already turned most of them into reality. They perform 5 core functions.

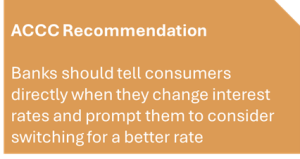

1 – Better available rate alert

Upworth´s scanner

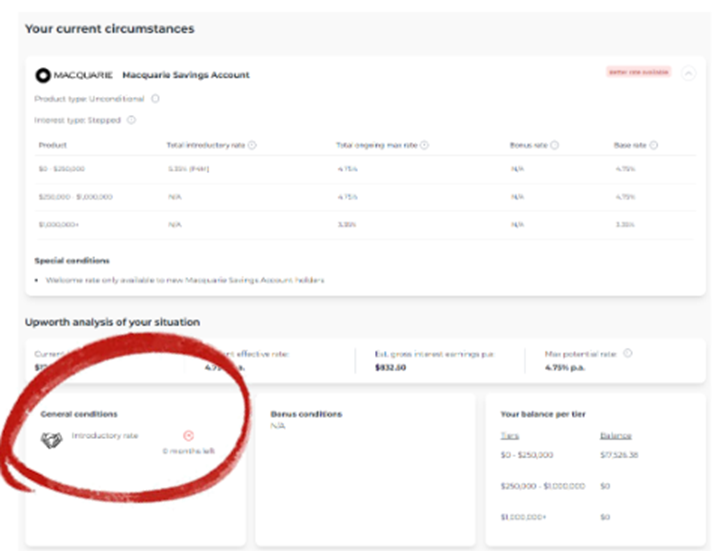

EXHIBIT 1 – Overview of Upworth´s personalised rate alert

- Upworth automatically identifies and lets you validate your current savings accounts to establish your baseline conditions;

- They then automatically compute your effective interest rate to establish the true picture of your earnings;

- They identify the best available rate across all available banks – not inside a given bank – considering your account balance. Then, they show your extra gross interest earnings potential over 5 years;

- They alert you by email whenever a better rate is available.

2 – Monitoring of bonus rate achievement

Upworth´s scanner

- You think you will beat the banks and always earn your bonus interest rate? Why not hold yourself accountable?

- Upworth automatically tracks your bonus rate achievement and sends a personalised periodic report.

3 – End of introductory rate alert

Upworth´s scanner

- Upworth goes beyond the ACCC recommendation. Not only do they give you a view of any introductory rate, but they also let you know the amount of time left before an introductory rate lapses;

- Additionally, they send you an email alert when your introductory rate expires.

EXHIBIT 2 – End-of-introductory rate tracking

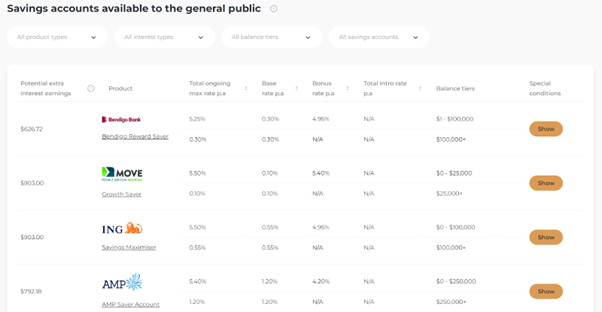

4 – Clear disclosure of all products details and self-directed tools for decisioning

Upworth´s scanner

- Upworth transparently displays all the publicly available offers (excluding products with special characteristic requirements such as age or profession).

- They do not sort results according to any commercial logic. In fact, they designed their search functions the way they have also wanted to set them up:

- You decide what matters the most to you and can accordingly sort products by Total ongoing rate (a metric that excludes any introductory rate to show the long-term available rate made of base + bonus rate when applicable), Base rate, Bonus rate or Introductory rate. You can also sort the results according to our estimate of your extra 5Y gross interest savings (based on your current individual account balance or your combined balances. You also choose that setting);

- Additionally, you can decide to filter products the way you want to: conditional vs. unconditional, stepped vs. tiered interest payment type or by balance tier.

- Special conditions are highlighted in a clean way and an internet link to the product provider´s page is included.

- Upworth does not depend on external providers and self-maintain their database.

EXHIBIT 3 – Overview of Upworth´s self-directed savings accounts

5 – Clear transparency about commercial arrangements

Upworth´s scanner

- Upworth is very transparent about their savings accounts commercial arrangements: they have NONE. Nobody pays them to tell you which savings account to look at or how to look at it.

- Yet, as per the ACCC´s findings, comparison websites can be paid an average of around $10 per click. The ACCC notes that “products that are ‘sponsored’ are generally paying a higher cost per click amount in return for ‘top’ positioning in search results. In some cases, banks may pay a much more significant charge when a customer does follow through from a comparison website, to open an account; this charge can range from approximately $150–400 per acquisition depending on comparison website and bank.”

6 – How to get the benefits of the scanner?

In a few minutes and a few clicks, you can retake control of your savings. Here are the steps:

1) Create an account/sign up for free on https://upworth.com.au if you didn’t yet (2 minutes)

2) Go to add account – Savings Account and connect it (2 minutes)

3) Click on the notification ‘Savings Account Opportunity’ and you will see your situation and how much you are missing out! (2 minutes)

If you want to know more, you can also check out the Upworth whitepaper on Savings Account in Australia (https://upworth.com.au/savings_white_paper), explaining the key things you need to know about Savings Account, the behavioural biases you are most probably subject to, and more details on the power of the Upworth scanner.