TrigonX Market Update – 24 May 2022

TrigonX Market Update – Over the past week, BTC has been consolidating between $28,600 and $31,000. Regaining the $28,600 support level last week was seen as a positive for bulls, but after testing this level several times this week, it is unlikely this level will hold for much longer. If the $28,600 support breaks, BTC will likely set new yearly lows. A break above $31,000 would likely lead to a push towards $33,000. ETH is in a similar situation, consolidating around $2,000. Much of the industry still faces strong downside pressure as the S&P 500 continues to set new lows.

The Battle For Control – Bulls vs Bears

As of writing, the Bitcoin market has now traded lower for eight consecutive weeks, which is now the longest continuous string of red weekly candles in history. Generally all previous bearish moves involved at least 1 or 2 reversal candles, however after 8 weeks we are still yet to see a retracement candle.

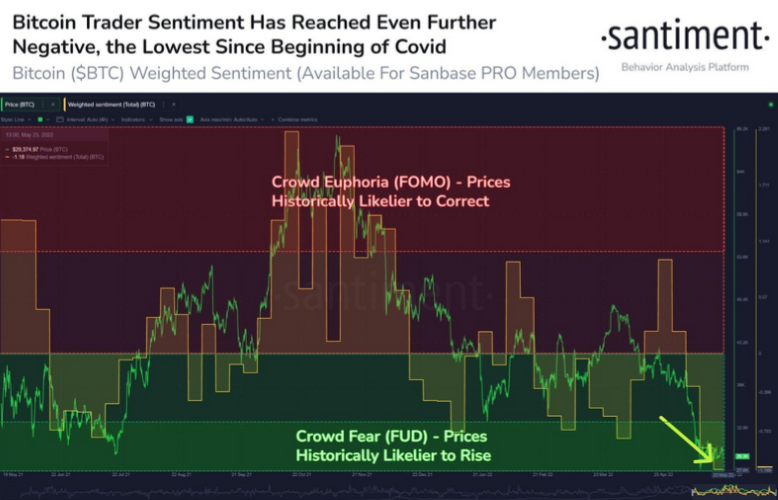

While speaking on the topic of bearish price action, it is important to highlight that social sentiment on Bitcoin is currently in the extreme fear zone as seen in the below chart. Historically, when fear in the market has been this high there is often large accumulation that occurs arounds these levels by whales scooping up Bitcoin at discounted prices, often sustained low prices can lead to a relief rally.

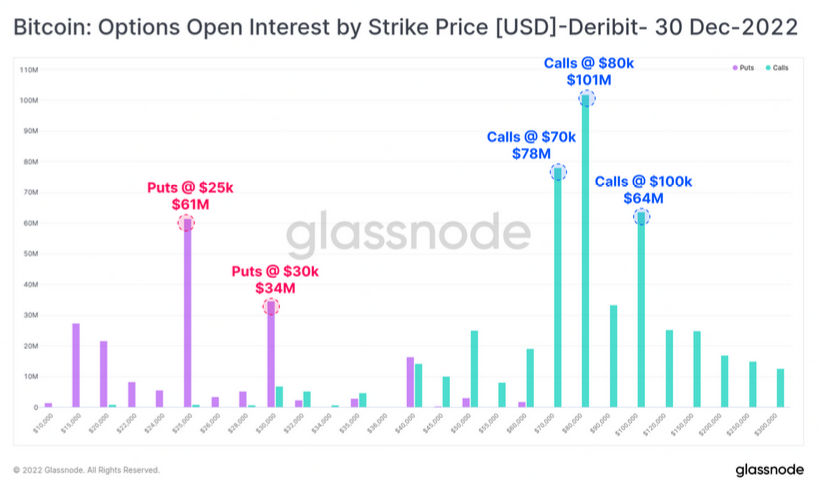

An important metric used to gauge market sentiment is the options market open interest. Open interest represents the total number of open contracts on a security at a set strike price. Whilst shorter term sentiment in the market may be bearish, if we take a look at the open interest for end of year expiry there is a very different picture being painted. There is a clear preference for call options around strike prices of $70,000 to $100,000, showing that the traders are somewhat uncertain about the shorter term price action but are rather confident we will see higher prices from here when looking out towards the end of the year.