Trade Ledger wins place in inaugural Hong Kong-UK FinTech Bridge Program

HM Treasury & The Department for International Trade select world’s first open banking business lending platform for tailored program of support aimed at boosting UK fintech industry

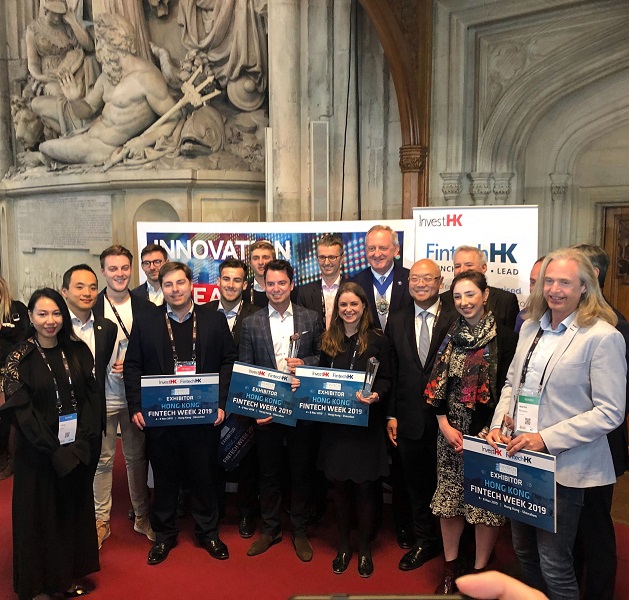

The world’s first open banking business lending platform, Trade Ledger, has won a place in the inaugural Hong Kong-UK FinTech Bridge Program announced last night (29th April 2019) at a special event hosted at Mansion House by the Lord Mayor of London. In just three years Trade Ledger has established its ground-breaking business lending platform on three continents. This latest achievement means Trade Ledger is the first global technology platform to leverage both the AU-UK and UK-HK bridges.

Last night’s event, part of UK Fintech week, also celebrated the 1-year anniversary of the UK-AU FinTech bridge.

Commenting on its selection for the Program by the Department for International Trade and Invest Hong Kong, CEO and co-founder of Trade Ledger, Martin McCann said: “The global economic impact of under-supply of trade finance cannot be underestimated. But with the advent of open banking and the evolving FinTech ecosystem there is now a once-in-a-generation opportunity to truly revolutionise the global marketplace. Gaining the support of the Department for International Trade, Invest Hong Kong and other partner organisations on the inaugural Hong-Kong-UK FinTech bridge will provide Trade Ledger with new avenues of support to continue to build the network of organisations that can benefit from this banking revolution.

“There was considerable competition to be selected for the UK-HK FinTech Bridge program and Trade Ledger’s success demonstrates our standing, calibre and international capacity, providing the firm with further support to achieve our international ambitions”, concluded Martin McCann.

Trade Ledger automates the end-to-end process of digital business lending for banks and alternative finance providers and has already achieved significant growth, working with large global trade banks & alternative finance providers across three continents.

With a focus on driving industry standards in the global corporate lending sector, it has recently published a white paper – From Open Banking to Global Business Finance – to set out the parameters for ensuring open banking equips SMEs to drive global growth.

The Programmes are highly competitive, with industry experts selecting just 10 companies to take part in each this year (20 companies in total). The businesses have demonstrated notable success in their sector and represent some of the best of UK FinTech’s ecosystem’s growth and innovation potential. Other companies selected alongside Trade Ledger in the Hong Kong-UK FinTech Bridge include TransferWise, Seedrs and Onfido.

The Fintech Bridge Pilot Programmes have been launched at a pivotal time for UK FinTech, which rose by 18% to $3.3 billion in 2018 and VC investment reached a record $36.6 billion across 2,304 deals, a 148% increase from previous years.

As part of the 2019 FinTech Bridge Pilot Cohort, Trade Ledger will receive a tailored program of support from the Department of International Trade, Invest Hong Kong and other partner organisations including:

• Support to develop business relationships and opportunities in Hong Kong

• Specialist professional services assistance (Lawyers, Tax experts, Accountants, Consultants etc.)

• Connectivity with regulators

• Curated events and dedicated sessions with industry experts