Top countries and brokers Aussies use to invest in global markets

The 2021-2022 financial year has been a year of ups and downs for Australian investors, with the ASX 200 ending the financial year down over 10% – a stark contrast to the steady upward trajectory the index saw in FY20/21. While a combination of economic and geopolitical events have caused markets to experience volatility worldwide, savvy Australian investors have looked outside the box and diversified into global markets.

Based on data from Sharesight’s userbase, this blog delves into the most popular global markets for Australian investors and some of the reasons why these markets were in such high demand during FY21/22. We also examine the top brokers for international trades and some of the features these brokers have that make them so sought-after by Australian investors looking to diversify their portfolios.

Most popular countries for Australian investors

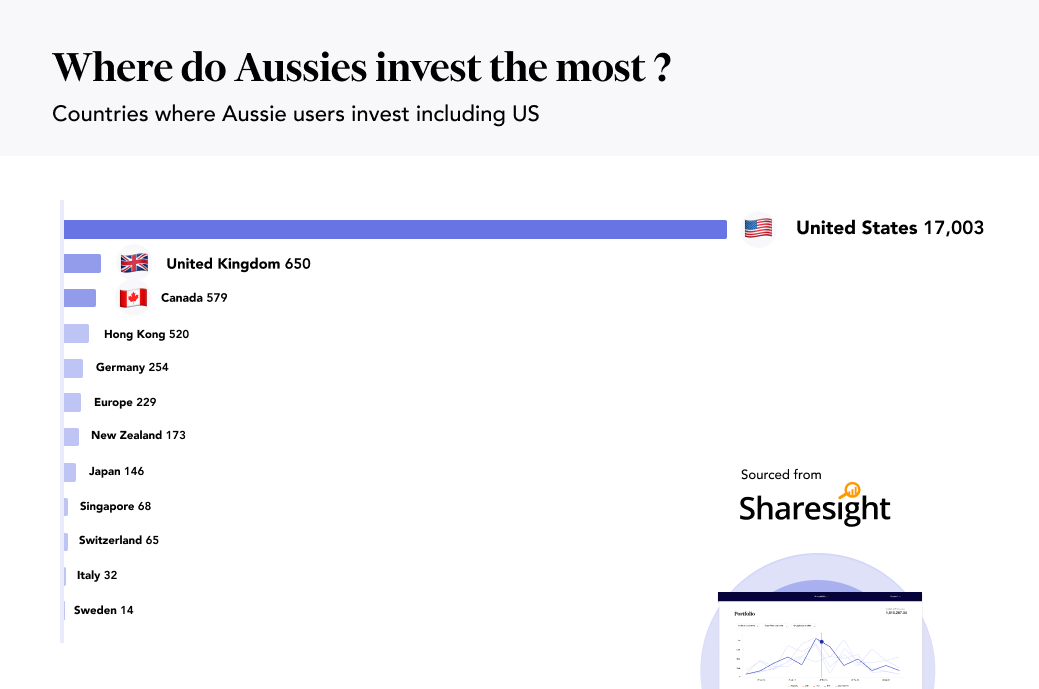

As you might expect, the US was by far the most popular choice for Australian investors, with over 17,000 investors trading in US markets during FY21/22, compared to just 650 investors investing in the UK.

International markets most popular with Australian investors, based on Sharesight’s userbase

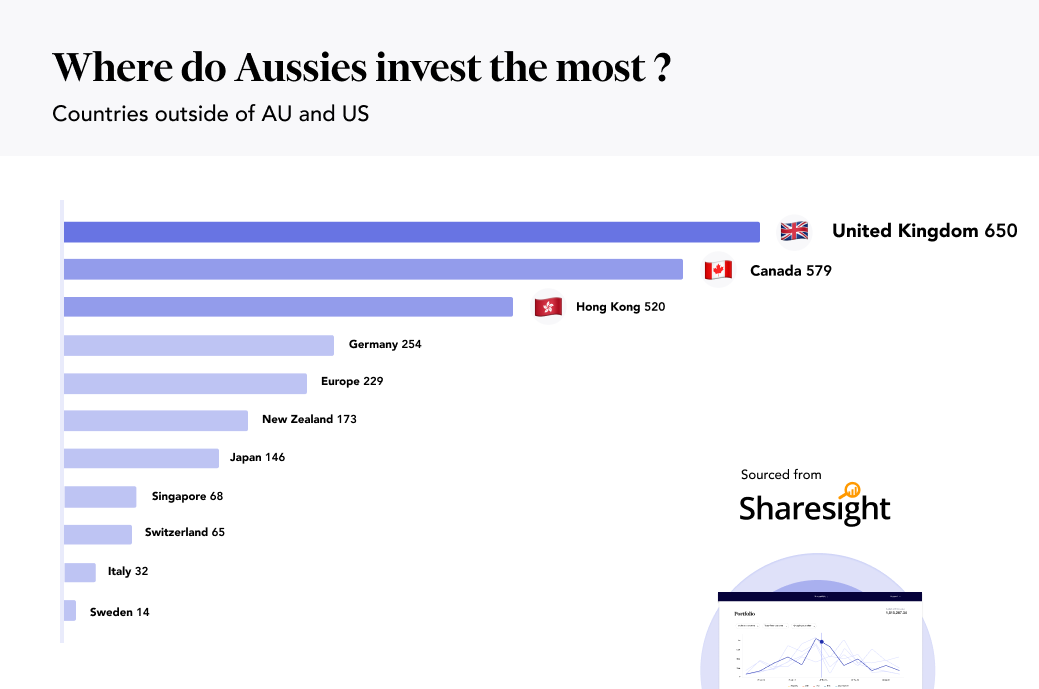

When the US is removed from the dataset and we zoom in to look at the remaining international markets, we can see that the UK, Canada and Hong Kong are also popular choices for Australian investors.

International markets most popular with Australian investors, excluding the US.

Why Australian investors are investing in overseas markets

With the value of the ASX dropping by around 10% in FY21/22, savvy investors have been seeking to diversify their portfolios by investing in overseas markets. For investors worldwide, US markets such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), Hong Kong Stock Exchange (HKEX) and Nasdaq are typically popular choices as they provide investors with access to some of the world’s highest-valued companies, along with a diverse range of industries and sectors.

Looking at the charts above, we can also observe a correlation between the most popular international markets and Australian expat numbers. For example, as of 2021, the US, Hong Kong, Germany and New Zealand are all part of the top 20 most common countries for expats to Australia. Other potential explaining factors for Australian investors’ preferred investment markets include similar currency conversion rates between the Australian and Canadian dollar, as well as the tendency for investors to invest in markets where they understand the language.

To read more, please click on the link below…

Source: Top countries and brokers Aussies use to invest in global markets