Top 5 Fintech and Banking Trends for 2017

FinTech Competition Will Drive Banking Transformation

FinTech companies are competing with banks on a number of levels including peer-to-peer (P2P) payments, lending, saving, and investing. Banks should especially be worried about the fact that 33% of millennials don’t believe they’ll need a bank in the next 5 years, and almost 75% of millennials reported that they are more interested in financial offerings from Google and Amazon that from traditional nationwide banks. For banks to continue to compete, they’ll need to make sure they are providing better services and customer experiences than both their bank competitors, but also upstart FinTech companies.

Continued Shift From In-Branch to Digital Channels

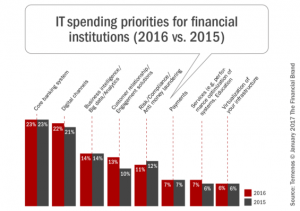

Millennials are driving the overall shift from in-branch banking to digital channels, and we predict that this trend will continue, if not accelerate, into 2017. The Financial Brand recently found that banks are spending 22% of their budgets on optimizing their digital channels, the second most important investment priority behind their core banking systems. If you aren’t devoting a large percentage of your 2017 budget to transforming your digital onboarding experiences, it’s time to reassess your approach.

Open Banking Will Gain More Acceptance

Historically, banks have been hesitant to integrate their systems with 3rd party software and platforms due to strict consumer privacy laws and harsh penalties for breaches. However, 69% of banks now see open banking as more of an opportunity than a threat, up from 50% last year. With a platform like Avoka Transact, and specifically Avoka Exchange, your bank will be integrate digital onboarding solutions with 30 other leading technology partners.

Customer Service Will Be The Most Important Differentiator For Banks

The proliferation of both traditional banks and now specialized FinTech companies means that consumers have more choice for financial products and services than ever before. To stand out amongst a crowded market, banks will be forced to invest in, and compete with, their customer experiences. Gartner found that 89% of organizations now compete primarily on customer experience, which means that banks who are looking to gain market share may be best served by focusing on service rather than products.

Internet of Things (IoT) Places Greater Emphasis on Digital Experiences

Most consumers aren’t interested in opening a checking account from their refrigerator (yet), but with the proliferation of the Internet of Things (IoT), banks need to be able to provide account opening abilities anywhere and with any internet-connected device. Expect to see this trend continue as IoT companies focus on improving user experiences on a multitude of devices. If your bank isn’t focused on building omnichannel digital acquisition processes, you’re already behind your competitors.

Article by:

Derek Corcoran, Chief Experience Officer at Avoka, where he counsels banks, insurers and wealth managers worldwide on improving results in digital multi-channel customer acquisition. Derek is a frequent industry speaker, whose presentations have been awarded Best of Show at two Finovate conferences in 2015.