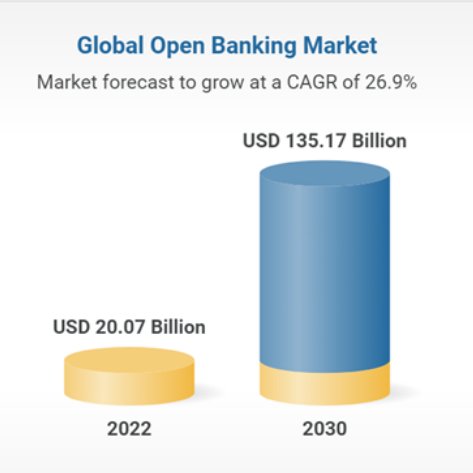

The Open Banking industry is expected to reach $135 Billion worldwide by 2030

The “Open Banking Market Size, Share & Trend Analysis Report by Services, by Deployment, by Distribution Channel, by Region, and Segment Forecasts, 2022-2030” report has been added to ResearchAndMarkets.com’s offering.

The global open banking market size is expected to reach US$135.17 billion by 2030, growing at a CAGR of 26.9% from 2022 to 2030, according to this study conducted.

The global open banking industry is expanding as a result of favorable government legislation, improved overall customer involvement made possible by open banking APIs, and an increase in the adoption of innovative applications and services. In addition, the relocation in the focus of retail banks toward consolidated technological enhancements also bodes well with the market’s growth.

Key industry players are aggressively investing in offering enhanced services to their customers. For instance, in June 2022, Mastercard announced its latest open banking feature, named Pay by link, through its banking pioneer in Europe, Aiia. This feature is expected to eliminate needless payment stages for companies from any sector by developing a straightforward link that enables clients to pay instantaneously in any situation. It is closely related to Mastercard’s open banking agenda, which seeks to usher in a new era of choice, convenience, and personalization in a secure manner.

Increased investment in the open banking space by prominent players is expected to drive market growth over the forecast period. For instance, Visa, Inc. purchased Tink in June 2021 for US$2.15 billion. The acquisition is anticipated to hasten the adoption of open banking in Europe through the provision of a reliable and secure platform for innovation. As a result, consumers have more control over their finances, including money management and financial goals.

The outbreak of the COVID-19 pandemic is expected to play a vital role in driving the growth of the open banking industry over the forecast period. Since the pandemic, the banking industry has been continuously evolving to improve the customer experience and ease the process of banking for consumers. In addition, the rapid adoption of digitalization is expected to create a positive outlook for the market.