The future of data-driven banking

Financial institutions are currently upgrading in the area of mobile and digital banking, creating ecosystems and launching digital second brands. A basic condition for fast and modern services is the availability of data.

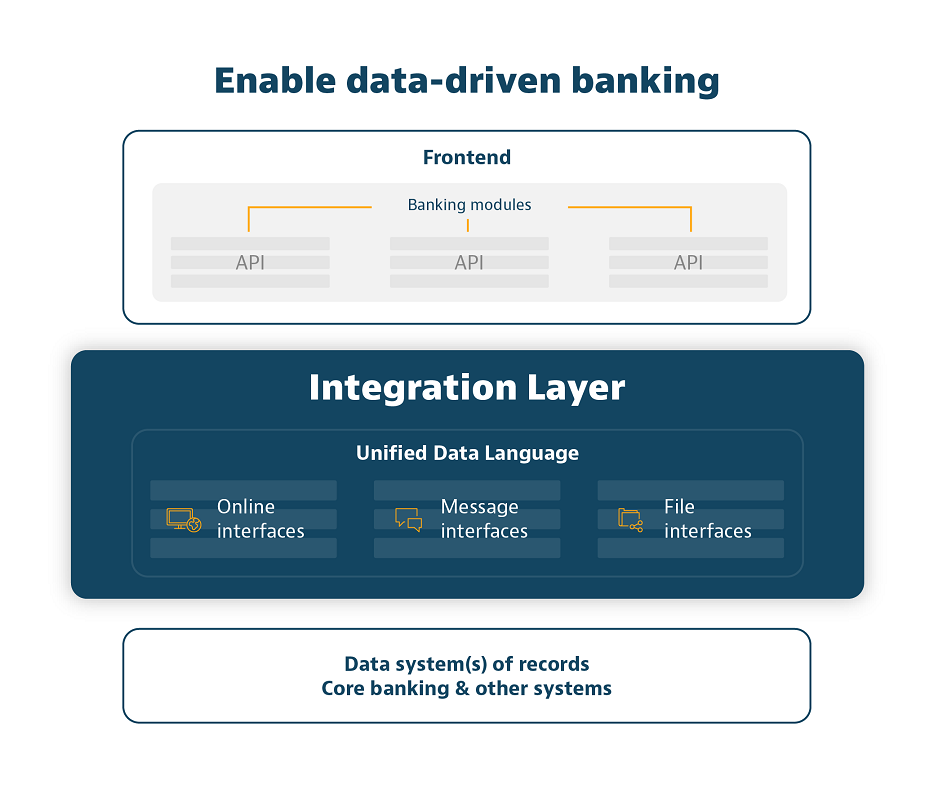

With an open integration layer, access to data is possible for a financial institution or its partners. Open integration layers free data from core banking constraints: data-driven banking, personalised offers, data-driven services for the customer and automation with fewer manual processes to modernise the digital banking offering.

Data-driven banking services can be used in the areas of partner ecosystems, new conversation channels, microservices or the integration of other data sources. If the frontend is decoupled from the core banking system, better customer interactions are achievable.

Decoupling systems

With increasing use of digital and mobile banking, data-driven banking means that banks can meet high customer expectations. In addition to the availability of data and an independent frontend, banks can reduce their dependence on the core banking system.

But how can this be implemented technically?

Detached from an often outdated back-end architecture, new services can be launched simultaneously and developed independently. This makes them accessible at any time and from anywhere. And by ‘anytime’, that can mean real-time availability. The bank can drive fast development and release cycles, which are crucial for successful digital banking providers. It is also possible to implement omnichannel strategies and make products more dynamic and automated.

Unified Data Language

The first step is to unify the data. Integration layers take over this step and enable frontends to communicate in the same “Unified Data Language”. Regardless of whether the data originates from core banking systems, CRM or other analysis tools, data can be unified in the integration layer and thus made more usable. To guarantee security at all times, it is also possible to identify and protect sensitive data.

Faster time to market

With this unified data, the user interface can be optimally configured, as well as data cached and adapted to the performance of the core banking system. Data conversion is therefore an integral part of the interaction layer and enables faster time-to-market.

New functions can be added at any time through additional initial data migrations. It is advantageous if the integration layer is also certified by the core banking system provider, so that any compatibility problems are prevented.

To read more, please click on the link below…