Symmetry Group collaborates with OpenInvest to launch digital investing solution Alliance Invest

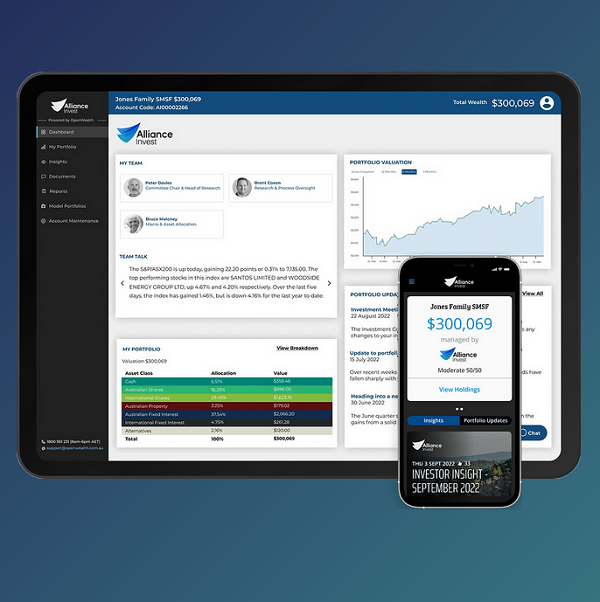

Perth-based financial advisory firm Symmetry Group have broadened its reach with the launch today of its digital investing solution, Alliance Invest.

Alliance Invest has been designed to enable everyday Australians to access the professional investing expertise of the experienced team at Symmetry, digitally, without the need to go through the personal advice process.

The Alliance Invest solution is being delivered in collaboration with Melbourne-based fintech investment platform, OpenInvest.

The Alliance Invest solution gives investors access to three investment portfolios managed to risk-based mandates (Moderate, Balanced and Growth), together with a regular flow of content: both explanations from the investment committee explaining their take on global investment markets and hence the rationale for their portfolio decisions, as well as a broad range of financial wellbeing content.

Peter Davies, Chairman of Symmetry Group’s Investment Committee, said that Alliance Invest had been designed to address a growing need by everyday Australians for simpler and lower-cost access to professional investing assistance.

“The personal advice service requires significant engagement with each individual. It leads to optimal outcomes for every client who can afford to go through that process, but as we know through the latest data on the “advice gap” in this country, a growing number of Australians either can’t afford the cost or don’t need personal advice. They just need help to invest sensibly – which means via a managed, diversified, multi-asset class portfolio,” Davies said.

Peter Davies added that this particularly applied to younger Australians, who might be quite early in their wealth-building journey and hence not yet able to justify the upfront cost of personal advice.

“All financial advisory firms are very aware of the need to help the children of their traditional client base of High Net Worth clients. It makes for happier and more successful family dynamics if all members of the family are on the same page, investing with professional assistance, and thinking about intergenerational wealth transfers in a strategic way. Now, with our new digital solution we are able to engage and assist all members of the family, not just the wealthy older members,” he said.

Founding Director Brent Coxon added that whilst he was encouraged by the initial recommendations of Treasury’s Quality of Advice Review, which if adopted would make for a simpler, lower cost personal advice experience, progressive financial advisory firms were taking positive steps now to leverage existing technology to help a broader audience of Australians.

“I’ve always been frustrated by having to turn prospects away, in many cases, people referred to us by existing clients, just because their circumstances didn’t warrant the cost of the full personal advice process. Now, with the launch of Alliance Invest, we can offer a solution for clients no matter their circumstances or levels of wealth,” Coxon said.

OpenInvest’s Head of Distribution Ravi Verma said that the firm was proud to be partnering with a high quality financial advisory firm that wanted to proactively take their expertise to a broader market, via technology.

“It’s interesting – and consistent with what I’ve seen throughout my career in this industry, both here and in the UK – quality financial advisory firms are not just great at running profitable businesses today, they’re also making decisions to grow into bigger and more profitable businesses tomorrow. They’re not sitting around moaning about excessive regulations and waiting for legislative change – they’re making decisions to use technology today, so as to build for the future,” Verma said.