Securing client data: What brokers need to know about the Essential Eight

By Peter Waring, CTO at JAVLN

Insurance brokers face increasing cybersecurity threats as they handle sensitive client data every day. Let’s face it, whether you’re running a small team of five or managing 50 advisors, if you hold an Australian Financial Services Licence (AFSL) or operate under one, the regulators expect you to keep up with cybersecurity standards. Right now, the Essential Eight framework is what everyone’s measuring against.

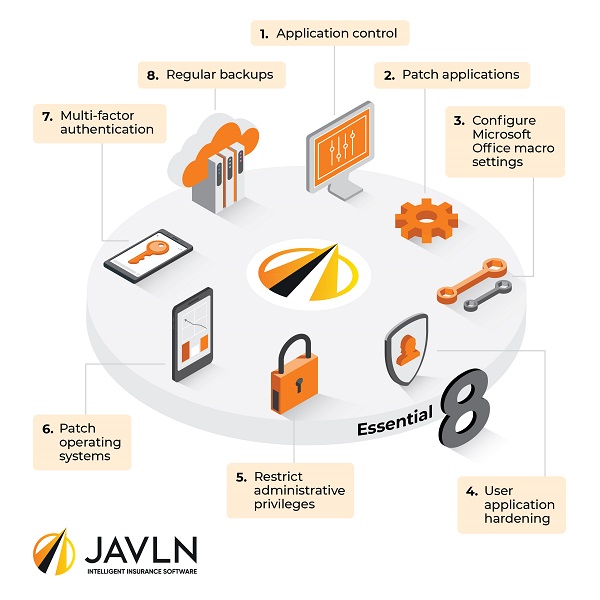

So, what is the Essential Eight?

The Essential Eight is a set of eight cybersecurity mitigation strategies developed by the Australian Cyber Security Centre (ACSC). While initially designed for federal agencies, these practices are now widely adopted and increasingly expected across private sector industries, including insurance.

For insurance brokers handling client data daily, these eight strategies act like a security net designed to prevent attacks, limit damage, and support recovery.

JAVLN Officetech delivers purpose-built document management software in the cloud for insurance brokers. It meets the requirements of the ACSC’s Essential Eight framework, with SOC2 Type 2 certification in progress.

Why cyber security matters for insurance brokers

Insurance brokers are prime targets for cybercrime. Storing sensitive client data and managing payments can leave brokerages vulnerable if they’re not properly prepared.

The Australian Securities and Investments Commission (ASIC) has already prosecuted financial services businesses for failing to meet minimum cyber standards under Section 912A of the Corporations Act.

APRA’s CPS 230 legislation, taking effect in July 2025, mandates stronger operational risk and third-party oversight, including cyber risk, for any regulated entities or those adjacent to them.

For brokers, data breaches are business survival issues. A security incident can lead to:

- Permanent damage to your reputation and client relationships

- Substantial regulatory penalties and possible AFSL implications

- Critical business interruption when you can least afford it

- Unexpected remediation costs that impact your bottom line

The Essential Eight framework provides a practical roadmap for protecting your business from these risks and giving you peace of mind.

Making sense of the Essential Eight

1. Application control

What it is: Only allowing approved software to run on your systems.

Why it matters: Stops malicious apps (like ransomware) from launching, even if they sneak in.

Brokers’ risk: Staff download a PDF from a fake insurer email. Without application control, it could open the door to a system-wide infection.

2. Patch applications

What it is: Regularly updating software to fix known vulnerabilities before they can be exploited.

Why it matters: Cybercriminals exploit old software to gain access.

Brokers’ risk: Outdated CRM tools or document viewers are common back doors.

3. Configure Microsoft Office macro settings

What it is: Restricting or disabling macros in Word and Excel files.

Why it matters: Macros are often used to deliver malware.

Brokers’ risk: An email attachment that looks like a client spreadsheet can launch harmful code if macros are enabled.

4. User application hardening

What it is: Locking down software (like browsers and readers) to remove unused features.

Why it matters: Limits the “attack surface” hackers can use.

Brokers’ risk: Default settings in your PDF viewer could allow silent installs or tracking scripts.

5. Restrict administrative privileges

What it is: Only giving admin rights to users who absolutely need them.

Why it matters: Limits the damage if someone’s account is compromised.

Brokers’ risk: If every team member has admin access, one hacked password can bring your whole system down.

6. Patch operating systems

What it is: Keeping Windows and other OS platforms fully updated.

Why it matters: Even the best software is only as safe as the system it’s running on.

Brokers’ risk: That old laptop someone uses “just for emails” might be your biggest risk.

7. Multi-factor authentication (MFA)

What it means: Adding an extra step (like a code or app) after entering your password.

Why it matters: Prevents account takeovers, even if someone guesses or steals a password.

Brokers’ risk: A phishing email tricks someone into sharing their login. MFA could block the breach.

8. Regular backups

What it means: Automatically saving encrypted copies of your data to a secure location.

Why it matters: If something goes wrong, you can recover quickly.

Brokers’ risk: A ransomware attack locks your client data. Backups are the only way back.

How JAVLN Officetech supports the Essential Eight

At JAVLN, security is built in. Our Officetech software delivers against all Essential Eight strategies. Here’s how:

✅ Secure cloud hosting via Microsoft Azure with layered protection

✅ Built-in MFA, access controls, and daily backups

✅ Role-based permissions that restrict admin rights

✅ Regular patching at the infrastructure and application level

✅ Macro-free environment that reduces email-borne threats

✅ Audit trails and encrypted storage to support compliance

And the best part? You don’t need to be a cyber expert to stay secure. We do the heavy lifting so you can stay focused on clients.

What this means for your insurance business

With JAVLN Officetech, you can:

- Prioritise your clients, knowing we handle the security side

- Prove you’re meeting key cyber risk obligations

- Protect client data from increasingly complex threats

- Strengthen your case for lower cyber insurance premiums

- Gain peace of mind that you’re working with industry-aligned techs

What this means for your clients

Your clients benefit from your investment in secure technology:

- Their personal and financial information is better protected

- They’re shielded from breaches that start in your systems

- They get uninterrupted service, even if something goes wrong

- They know their broker treats data protection as seriously as their policies

Ready to take the next step?

- Ask yourself: Are we aligned with the Essential Eight today?

- Review your systems: Where are the gaps?

- Talk to our team: Let us show you how JAVLN Officetech can help.