Equity Crowdfunding: A Fintech Story

by Steve Kourabas* Digital Revolution The period following the global financial crisis of 2008 has brought with it massive changes to the digital economy. Almost every human interaction, and almost every organisation, has been impacted by the technology boom, which has brought with it new opportunities for innovation and dynamism. Developments in the area of finance have been particularly pronounced, with Fintech (a contraction of “finance” and “technology”) offering the opportunity to an increasing number of consumers around the world at all income levels to participate in financial markets.[1] Equity Crowdfunding (ECF) is one such advancement in the Fintech space that offers the opportunity for small and medium enterprises […]

Bitcoin: Ten Years On

A mysterious, anonymous entity known as “Satoshi Nakamoto” posted a white paper on October 31 2008 entitled “Bitcoin: A Peer-to-Peer Electronic Cash System”. It was the first time that the concept of Bitcoin entered the world. But outside of the cypherpunk mailing lists – those promoting the use of privacy-enhancing technology – this event was hardly noticed. Ten years on, who hasn’t at least heard of the cryptocurrency? On just nine pages, the white paper explained how the Bitcoin system would work. Many attempts at electronic cash had already been made going right back to computer scientist David Chaum’s “Digicash” developed in the 1980s. Using an intricate dance of cryptography, […]

2018 AFR Young Rich List: Emily Skye backs Millennial bank start-up

Fitness star and Young Rich Lister Emily Skye may have built a small fortune but that doesn’t mean she’s good with money. “I’ve never really known what’s going on with money, I mean I love to spend it but I’m not able to track it and really be responsible for it,” Ms Skye said. Ms Skye rockets up the 2018 Financial Review Young Rich List with an estimated worth of $36 million, reflecting growth in her online fitness business that attracted an undisclosed investment from Quadrant Private Equity this year. As she continues to build the fitness business, including releasing the first app for her FIT program this year, Ms […]

From corporate career to FinTech leader of the year. The amazing story of Katherine McConnell

Katherine McConnell is CEO and Founder of Brighte. 3 years ago, Katherine was in a comfortable corporate job. Today she is Fintech Leader of the year, running a successful, rapidly scaling business and has the backing of Mike Cannon-Brookes. Dexter Cousins has been recruiting leadership talent for 20 years and no one has impressed him as much as Katherine. She is rightly hailed as an inspiration to female entrepreneurs. But her courage, commitment, vision and focus serves as an inspiration to everyone. From corporate career to FinTech leader of the year. The amazing story of Katherine McConnell. What motivated you to start Brighte? Katherine: The idea for Brighte came in […]

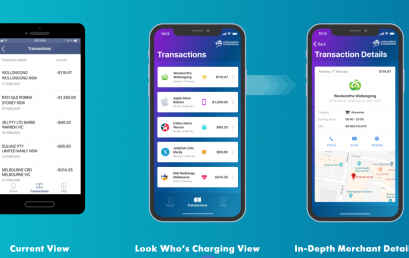

Local FinTech Look Who’s Charging eyes offshore expansion

Local FinTech start-up Look Who’s Charging has been selected as one of only 24 companies from around the globe to present their business on the centre stage at Money 2020 in Las Vegas this coming October. Look Who’s Charging is a Data as a Service business and one of the first companies globally to solve the problem of unrecognisable transactions. Look Who’s Charging links the often-random narratives from debit and credit card transactions to in-depth merchant details. NAB integrated Look Who’s Charging into their digital applications earlier this year. In the past 12 months Look Who’s Charging has helped to de-mystify over 15 million transactions many of which would have […]

The $4b buy now pay later startup built on a legal loophole

“I’m pretty bad when it comes to shopping,” Amanda*, a 23-year-old disability worker based in Melbourne tells Fairfax Media. “If I liked it, I’d Afterpay it”. It’s been said that the ultimate goal for a tech startup is to become a verb. If that’s the case, then Sydney-based Afterpay has well and truly made it. Amanda started using the buy now pay later service in 2016. She used it to purchase clothes, electronics and Christmas presents. But when her financial circumstances changed, she quickly ran into trouble. “When I started using it I was getting good money from work. I could afford the repayments, I always made sure I would […]

Australian startups selected for Accenture’s FinTech Innovation Lab

Eight leading fintech companies have been selected for the fifth annual FinTech Innovation Lab Asia-Pacific, a 12-week mentorship program created by Accenture. The 2018 program received a record number of applications, from more than 160 companies, and comes at a time when investments into the sector are soaring. According to an Accenture analysis of data from CB Insights, global investment in fintech ventures reached another all-time high in 2017, of US$27 billion, with continued growth in 2018. Launched in Hong Kong in June 2014, the FinTech Innovation Lab Asia-Pacific has received nearly 600 applications since its inception, with 33 companies participating to date. Alumni companies from the Lab have raised US$288 […]

WA Fintech business doubles following major acquisition

WA Fintech Fair Go Finance doubled in size from 1 July following the acquisition of Capfin Money, to create one of the largest non-bank personal loan lenders in the Australian small loan market. Fundco Pty Ltd which trades as CapFin Money (previously Spot Loans) was purchased by Fair Go Finance, providing an exciting opportunity to scale the Australian operations and access a wealth of data. The combined operations of Fair Go and Capfin now establishes the business as one of the largest non-bank personal loan lenders in the Australian small loan market. With this scale there are significant advantages as Artificial Intelligence (AI) becomes a reality in the risk management […]