The Next Trends in Australian Payments

James Vatiliotis, Head of Product at Zeller, shares his insights on the innovation we can expect to see in payment technology over the next 12 months.

Bizcap appoints Tony Truong as Chief Credit Officer and doubles the size of its credit team

Bizcap have announced the promotion of Tony Truong to the role of Chief Credit Officer and the doubling in size of its Credit team

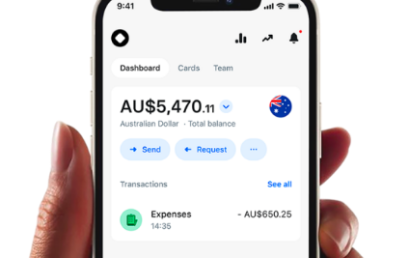

Revolut Business expands services to sole traders in Australia to better serve businesses and unlock greater market potential

Revolut have announced the extension of its Revolut Business product in Australia to include sole traders.

Banjo’s Federal Budget wishlist reveals top tips to boost SMEs

Leading non-bank lender Banjo Loans has revealed the five measures which small businesses are hoping to see in the upcoming Federal Budget.

Subscription bond service Bondable promises to shake up rental industry

Bondable has been launched to revolutionise the property industry and create a more affordable, transparent, and efficient rental system for tenants, agents, and landlords.

It’s a scam-filled Summer. Don’t get comfortable.

It’s peak shopping season. The height of summer sales is great news for consumers – and it’s even news better for scammers.

eBev joins forces with Spenda to implement frictionless payment options across their marketplace network

Spenda has entered into a binding MOU with eBev, Australia’s largest marketplace for wholesale beverages, to integrate payment solutions into their platform.

The year that was: 5 trends that shaped 2023 for financial institutions: Sandstone Technology

The pandemic, economic volatility, social and behavioural change, followed by corresponding waves of tech advances.