Rollout of Merchant Choice Routing for mobiles plus lower eftpos debit charges will lower the cost of payments in Australia

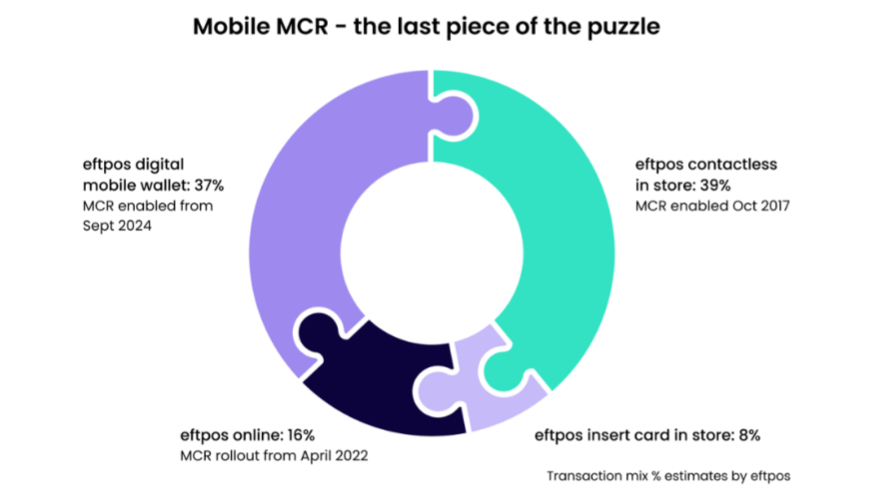

Australian Payments Plus (AP+) have announced the rollout of Merchant Choice Routing (MCR) on transactions made via mobile wallets has now commenced, meaning that merchants can choose1 to have more payments routed via the lower cost eftpos network – and that eftpos can bring important price competition to the nearly half of all transactions which are expected to be made via mobile wallets.

Adrian Lovney, AP+ Chief Payments Officer, said, “eftpos brought price competition to contactless payments in stores in 2017, we brought it to online payments with wide availability by 2022 and now we’re bringing it to mobile wallets. Why is this important to businesses and consumers? Because eftpos fees are 40% lower on average for debit cards.”

A mark of the competitive role eftpos plays is that it now has around 35% share of all debit card payments made online after only being widely present in this segment for just over two years.

Merchant Choice Routing (MCR) for eligible mobile devices kicks off

Nearly half of all card transactions are expected to be made via a mobile device in Australia2. Until now, and unlike transactions conducted with a dual network debit card in person or online, merchants could not choose a lower cost network to process these transactions. They had to rely on a subset of Australian consumers choosing the eftpos network in their mobile wallet. eftpos data shows that only 1 in 11 consumers made this choice – most likely to avoid higher merchant surcharges.

From now, when a consumer pays using an eligible card in a mobile wallet, merchants can also have the choice to process payments via the lower-cost eftpos network, allowing eftpos to bring meaningful competition in this segment which is expected to make up nearly half of card transactions made by 2027.This is a progressive rollout based on new wallet registrations, dependent on handset manufacturer. For some devices this will be available progressively by bank while for other devices this will be where a new card is registered following a software update.

Lowering eftpos pricing for small business

This news comes as AP+ has also announced new eftpos interchange rates for small business merchants, as part of its ongoing commitment to lower the cost of payments.

Effective 1 December 2024, the interchange for all card present transactions, including mobile wallets, will reduce to 2c per transaction for eligible small business merchants5. Online transaction interchange has also been reduced to 3c per transaction for eligible small businesses5.

In addition to these new strategic interchange rates for small business merchants, eftpos has recently announced a reduction of issuer scheme fees by 22% and acquirer scheme fees by 5%, commencing from 1 May 2025.

Lovney added, “RBA analysis showed eftpos fees were already 40% lower on average for debit cards and now we’ve lowered the cost of interchange and network fees for small businesses even further. Lowering the cost of payments in Australia is a fundamental part of the AP+ purpose. Right across all the AP+ payment schemes we’re committed to lowering the wholesale cost of payments. It’s all part of having strong and competitive payment systems that serve the needs of businesses and consumers in Australia.”

Surcharging in the spotlight

The RBA has indicated that it will soon release a discussion paper on possible changes to Australia’s approach to surcharging for card transactions. Regardless of any changes that may come, these developments will enable more transactions to travel via the eftpos network at lower cost, all helping to reduce the prevalence or level of surcharging.