Plenti continues its strong growth momentum, launches GreenConnect POS platform

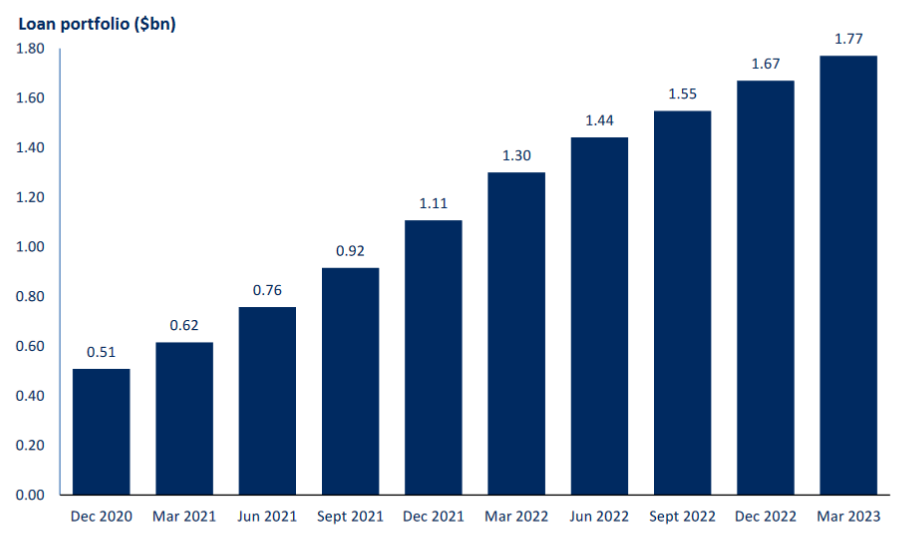

Plenti has provided a trading update for the quarter ended 31 March 2023 (4Q23), with highlights including their loan portfolio has increased to $1.77 billion (36% above PCP and 6% above prior quarter) and loan originations of $276 million, with seasonally lower originations in January and February followed by stronger originations of $111 million in March 2023.

Commenting on the quarter, Plenti CEO Daniel Foggo said, “Our continued investment in our technology-led customer experience and efficiency advantages has delivered another strong quarter for Plenti.

“With our continued momentum and healthy net interest margins, we enter our new financial year confident of our ability to drive both strong loan portfolio growth and business profitability.”

Plenti’s loan portfolio, which is a key driver of revenue, increased to $1.77 billion at 31 March 2023, up 36% from 31 March 2022 ($1.30 billion) and up 6% from 31 December 2022 ($1.67 billion).

Loan originations and margins Total loan originations for the quarter were $276 million, lower than the prior comparable period (PCP) and prior quarter as Plenti continued to prioritise net interest margins. However, loan originations strengthened in March reaching $111 million, supported by reduced competition and higher competitor pricing in some key lending channels. This strength has been sustained into April.

Automotive loan originations were $127 million, versus $142 million in the prior quarter, reflecting a seasonally quieter quarter for the automotive vertical. Renewable energy loan originations were $36 million, a record quarter and 5% above the prior quarter.

Personal loan originations were $113 million, down 7% on the prior quarter, again reflecting usual seasonality.

Plenti continued to prioritise loan profitability throughout the quarter, which was helped by the positive developments in the competitive environment and supported stable portfolio margins.

During the quarter, Plenti launched GreenConnect in March 2023, an innovative point-of-sale platform which brings together renewable energy product manufacturers, energy retailers, equipment installers, and Plenti’s cost-effective finance, to provide Australian households with access to a broad selection of more affordable home solar battery systems.

By combining all services into one platform, Plenti and the major industry participants who are participating on the platform, are making the purchase of a solar battery system simple and easy to understand, whilst improving the economic value provided to homeowners.

Plenti completed a $300 million personal and green loan ABS transaction in February 2023, which increased its total ABS issuance to over $1.3 billion, and refreshed capacity in its personal and green loan warehouse facility.

Plenti continued to provide investors on its retail investor platform, the Plenti Lending Platform, with an ability to invest in notes issued as part of its ABS transactions via the new Notes Market, which was launched at the end of the prior quarter. As well as providing investors on the Plenti Lending Platform with access to higher investment returns and providing further diversity to Plenti’s ABS funding, the Notes Market has released corporate capital which has been invested to support growth in other funding structures.