Pearler revolutionises auto investing and launches Roundup feature

Pearler, Australia’s leading long-term investing and wealth management platform, has made CHESS-sponsored investing hassle-free by adding new features to its Automate product.

The changes will give Pearler members more freedom to manage various external bank accounts, automated investing across Australian and US shares, managed funds and even philanthropy. Customers can manage the full suite of Pearler products in one experience including trades that can execute on your behalf without needing to time the markets and without the complexity of managing multiple bank transfers.

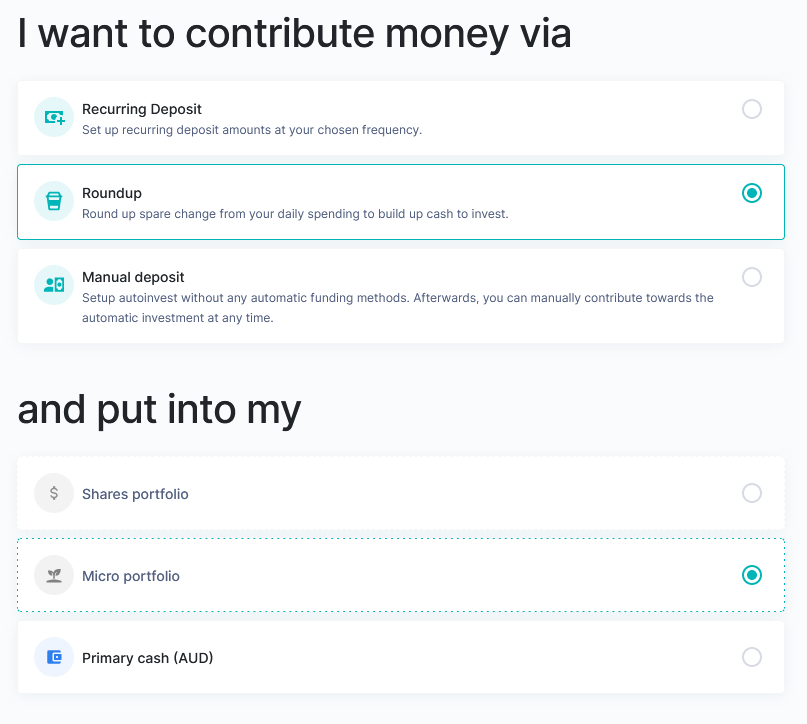

Additionally, Pearler has launched Roundup investing which will allow members to invest their spare change across diversified options.

“Gamified or speculative trading has taken the spotlight these last few years, but we don’t think this ends up helping many people. Blocking out market noise and simply investing regularly isn’t as exciting, but we are trying to change that,” said Nick Nicolaides, Co-Founder and CEO of Pearler.

“Pearler launched auto investing capabilities via its Automate product in 2021 with unique ‘set and forget’ investing functionality to promote regular buy-to-hold behaviour in contrast to trading. Approximately 50 per cent of investors on our platform are using it to automate deposits or rebalance their portfolios. Trading behaviour mirrors the functionality of the tool, with 90 per cent of transactions being buys and only 10 per cent sells.

“Other investment apps that promote automation features don’t necessarily offer investing via the security of your own HIN. With Pearler, hands-off investing doesn’t mean you need to give up control and security,” added Nicolaides.

Technology has democratised how we invest today, notes Hayden Smith, Co-Founder and CTO of Pearler.

“We are constantly striving to make our platform deliver tools that can create a community of successful, long-term investors.

“Every dollar counts. Automatic investing has given investors the ability to set money aside for wealth generation consistently. The amount and frequency is pre-determined and combined with Roundup and investing spare change, we believe, is a great pathway to building long-term wealth and financial wellbeing,” said Smith.

“For example, members can now use Roundups to go into either the Shares option (which offers direct shares and ETFs investing) or Micro (which is micro-investing and a most popular option for beginners).

“Members can now consolidate all automatic deposits and spread it across options such as Shares, Micro, and Primary Cash (e.g. 80% into Shares, 20% into Micro),” said Smith.

“All this flexibility allows our investors to take the emotion and friction out of investing. We want to minimise the stress around hitting that ‘buy’ button,” added Nicolaides.