Lakeba achieves $20M startup sales record for Paid By Coins

Australian technology innovator Lakeba, who has launched over ten new ventures in the Australian market since 2016, today announced the $20M sale of their Paid by Coins venture to Mobecom (ASX:MOB) only seven months after launching the platform in early 2018. “Lakeba built, deployed and exited the Paid By Coins business in less than seven months, achieving what few startups have before them. This accelerated acquisition timeline demonstrates the rigour and depth of Australian innovation and sets a new benchmark for the rapid commercialisation and sale of market-relevant, high demand emerging technology solutions,” said Giuseppe Porcelli, CEO and Founder of Lakeba. Paid by Coins is a secure payment solution for consumers, enabling […]

Industry experts appointed for the next phase of Peppermint’s strategic growth

Peppermint Innovation Ltd (ASX: PIL) today announced the appointment of two strategic advisors to assist in implementing the Company’s next phase of growth. Ms Gayle Cilfone has been appointed a Key Compliance Consultant to the Company and Mr Colin Chandler is taking up a position as a Strategic Advisor to the Board of Directors. Commenting on the respective appointments, Peppermint’s Managing Director Chris Kain said, “Gayle Cilfone has more than 20 years’ experience in the financial services industry, with specific expertise in compliance and risk management. Her skills set in the area of compliance and regulation will be very valuable for the Company’s remittance operations. “Colin Chandler brings to Peppermint […]

MT4 tech specialist Gold-i opens an office in Australia

MetaTrader technologies and integration specialist Gold-i has announced that it has opened an office in Australia, headed up by FinTech sales and technology specialist, Daniel Picone. The new Sydney-based office is a significant development for Gold-i as it focuses on increased business opportunities amongst brokers in Australia and New Zealand as well as expanding its footprint across the Asia Pacific region. Daniel Picone, who has spent the last seven years at Australian FinTech company, IRESS brings a wealth of experience to the role in terms of business development, account management and client support. He has spent four months on an intensive training programme at Gold-i’s UK headquarters in preparation for […]

No more updating card details: Visa rolls out tokens online

New digital payments technology from Visa is set to significantly reduce ecommerce fraud, while removing a major consumer pain point – updating your details online every time you get a new card. The technology, called credential-on-file (COF) tokenisation, means that card details such as the 16-digit account numbers and expiry dates will no longer be stored online when consumers make a purchase. Instead, COF removes sensitive information from merchants’ systems and replaces it with a token, which is meaningless if stolen by fraudsters. Visa’s head of digital product and partnerships for Australia, New Zealand and the South Pacific, Matt Wood, told The Australian Financial Review the tokens would be linked […]

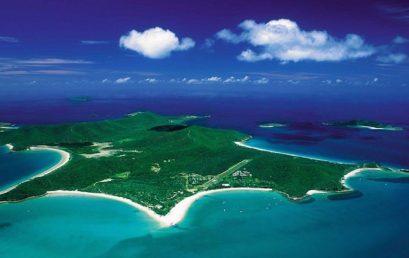

Cryptocurrency behind Great Keppel Island’s $300 million resurrection

There was a time when Great Keppel Island was sold as the ideal place to go and “get wrecked”, a party island at the gateway to the Great Barrier Reef. It then faded into disrepair and then into memory. Now an ambitious cryptocurrency consortium plans to resurrect it as a high-tech wonderland including a luxury resort, private villas and apartments, a golf course, retail outlets and a marina in what is being sold as the world’s largest cryptocurrency-backed property deal. If all goes to plan, they boast, when the development is complete Great Keppel will become the world’s largest island cryptocurrency micro-economy, a project that could bring the new digital […]

UK fintech ‘unicorn’ Ebury heads to Australia

British fintech firm Ebury has set up shop in Sydney, having identified the Australian market as a good foothold for southern hemisphere expansion.

Apple is becoming a formidable financial technology company

A growing anxiety for bank executives is how and when big tech companies will encroach on their turf. During its quarterly earnings call yesterday, Apple CEO Tim Cook gave some insight into the company’s progress in becoming something of a fintech player: Apple Pay transactions tripled from a year earlier, to more than 1 billion. Cook said that was more than Square and exceeded mobile transactions via PayPal. The worry for finance executives is that payments are just the beginning. Alibaba affiliate and fintech giant Ant Financial expanded from payments and into wealth management. According to analysts at research firm Bernstein, the Chinese company now runs a robo-advisory service that […]