Outsourced commission processing: a risk-managed approach

By Jeff Deakin, Director, CoMetrix

Why outsource?

As an AFS Licensee, you know that significant savings can be made by outsourcing those less strategic, but operationally important, business activities that do not contribute significant value to your business.

Business activities that make the most significant contribution should be retained in-house. These include: your intellectual capital, advice process, adviser relationships, buying power, compliance management, research etc.

Activities that tend to be less strategic, but operationally important, can be outsourced to partners who specialise in these areas, without impacting the value of your business. These activities include execution of compliance reviews, paraplanning and commissions processing.

Cost savings – are there hidden costs?

A key factor affecting your profitability is controlling the costs of delivering services to your adviser network. But cost savings are only part of the picture. You can build the most value by focusing on maintaining and improving adviser service delivery, managing business risks, and enhancing your business value proposition to retain your existing advisers and attract new advisers.

The cost of outsourcing needs to be considered relative to the total cost of delivering the service yourself. The total cost includes several types of risks – and these are not always easy to identify.

Outsourced commission processing

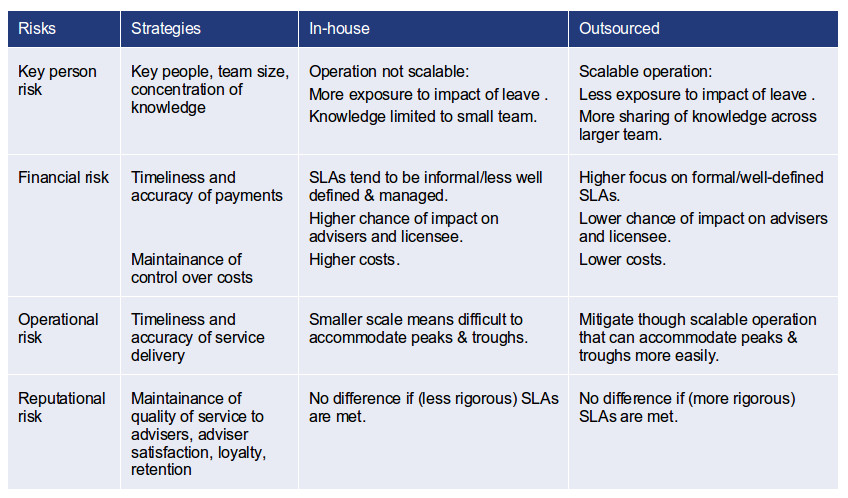

Whether or not you outsource your commission processing, there are risks to consider.

Choosing a supplier

Choosing a supplier

You can best manage your risks by carefully choosing the right supplier, however the wrong choice could inadvertently increase your risk.

When choosing a partner, some questions you may wish to ask include:

- What is the scope of their service? Since a significant part of the work involves interacting with suppliers, handling emails, handling adviser queries etc, how many tasks will you still have to do? Or do they provide a complete end-to-end service?

- Do they offer a Service Level Agreement?

- Are their customers satisfied? Have they achieved cost savings?

- Are they good to work with? Can they become your trusted partner that is more like an extension of your business than just another supplier? Will you be just another customer to them or be a vital part of their business?

- Is the software they use controlled by a third party? Can your partner obtain timely updates to ensure they meet their service levels – for example, when provider data formats change without notice?

- Are they committed to a formal written information security policy? Has it been reviewed by an informed external party?

- Does their information security including backup processes meet high standards? Do they have a disaster recovery plan and a business continuity plan?

- Has their security been rigorously vetted? Have their systems been subjected to penetration testing? Have their business processes been scrutinised?

- Is their office located in Australia or off-shore? Could different time zones and/or language issues impact time-critical communications with your advisers and providers?

- Is their data centre, or the data centre used by any of their suppliers, located offshore? Are the suppliers obliged to provide your clients’ highly sensitive data to foreign government agencies? What impact could the CLOUD Act have?

- Is your data properly partitioned from that of their other clients or is it all in one database?

- Do they use a file hosting service to transmit data? Is it secure? Have there been any security incidents or breaches? If so, how have these been addressed?

Striking the right balance

All business strategies, including outsourcing, necessarily involve risk, and there is no panacea.

If you can strike the right balance, your advisers will remain satisfied and loyal, you will attract new advisers, and your business will flourish even more.

If outsourcing is part of your risk management strategy, you can achieve an optimal outcome by asking good questions, which will lead you to the right partner.

CoMetrix

CoMetrix Revenue and Remuneration (RnR) is a secure, accurate, scalable and robust solution solution for AFS Licensees that face the complexity of managing and accurately distributing revenue from diverse fund managers, insurance companies and lending institutions to their authorised representatives.

Commission processing is an ideal candidate for outsourcing. Recognising that your business must balance the inevitable risks associated with performing this function in-house or by outsourcing it, we provide a secure, scalable and reliable full service offering that can help you manage your risks and achieve significant cost savings.

Further information can be found at www.cometrix.com.au/services.html.