Open Finance platform Basiq announces strategic partnership with FrankieOne

Basiq and FrankieOne are pleased to announce they have entered into a strategic partnership, combining FrankieOne’s identity, compliance and fraud prevention solution with Basiq’s financial data insights.

The onboarding of customers is just the first phase of a customer experience, but having an ongoing understanding of your customer’s financial position can help deliver a more personalised experience and in turn greater total customer value.. The partnership will bring together deep skills and expertise in customer onboarding compliance processes and fraud prevention from FrankieOne, together with insights into a customer’s financial history from Basiq.

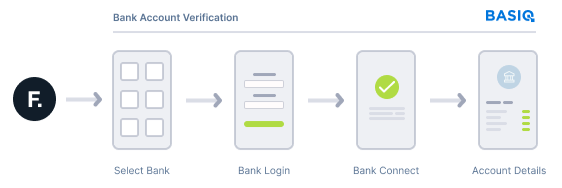

When banks, fintechs and financial institutions onboard customers, identifying who the individual is and understanding their financial behaviours are two important components in delivering a great customer experience and building a strong customer relationship. A fast and seamless process in performing these two tasks can go a long way toward successful acquisition and retention. By bringing together the capabilities of Basiq and FrankieOne, businesses can perform the necessary KYC/AML checks, verify bank account ownership and obtain a complete financial view of the consumer through a single API.

“As Open Finance continues to accelerate, the ability to obtain a complete financial view becomes essential in offering personalised services for current and future consumers. Basiq recently announced the latest Basiq 3.0 platform upgrade that enables fintechs to access Consumer Data Right (CDR) Open

“Banking data and via web capture for financial institutions that are not yet part of Open Banking,” says Damir Cuca, CEO & Founder of Basiq.

“An identity check/fraud assessment together with insights on financial behaviour are common challenges for banks, fintechs and financial institutions to solve. By combining these services together, it will enable businesses to accelerate the onboarding process and obtain a complete financial view of the consumer.” says Damir Cuca.

Simon Costello, CEO of FrankieOne added, “We view the partnership with Basiq as a key component of the FrankieOne solution. We are strong believers in open banking and consumers being able to consent to sharing their banking data, which will enable businesses to better understand and build deeper relationships with their end customer. Basiq and FrankieOne share the same philosophy of being API-led, enabling businesses to integrate seamlessly and have full control of the customer experience.”

The combined services of KYC/AML, account verification and insights from financial data can now be accessed via a single API. It enables banks, fintechs and financial institutions to focus on innovation and their core business of driving value for their end consumers.

For more information, please contact Jake Osborne from Basiq [email protected] and Toni Knowlson from FrankieOne, [email protected].