Ode to Charlie – ‘Architect’ of Berkshire Hathaway

By Jodi Stanton, Founder and CEO of Rush

Introduction

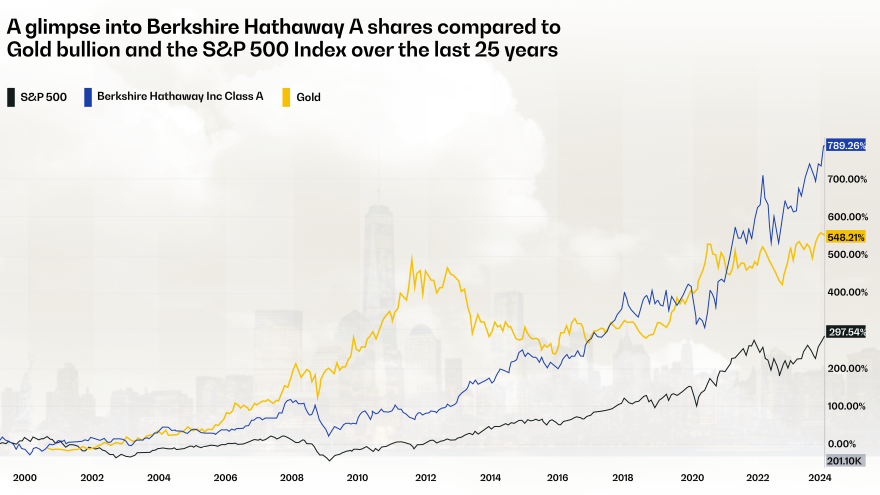

At the tender age of 18, I took my first steps into the world of investments with a bold move – purchasing both gold and Berkshire Hathaway A stocks. Little did I know that these early decisions would lay the foundation for a robust and diversified investment portfolio that would stand the test of time. As my career unfolded in risk management, private equity, and entrepreneurship, the wisdom of Charlie Munger (pictured) became a guiding force, shaping not only my understanding of investments but also influencing the establishment of my own venture, Rush. This journey reflects the synergy of my experiences, Munger’s mental models, and the drive to address the vulnerabilities I perceived in the financial markets.

Early Investments in Gold and Berkshire Hathaway

At 18, my decision to invest in both gold and Berkshire Hathaway A stocks marked the beginning of an exciting financial journey. Gold, with its historical role as a hedge against economic uncertainties, and Berkshire Hathaway, led by the legendary duo of Warren Buffett and Charlie Munger, represented stability and wisdom. Over the years, these investments served as cornerstones in my portfolio, providing valuable lessons in long-term thinking and the importance of backing fundamentally strong assets.

Learning from Charlie Munger’s Mental Models

While my initial foray into investments preceded a deep understanding of Munger’s mental models, it was in the subsequent chapters of my career that I truly grasped their significance. As I delved into risk management, private equity, and entrepreneurship, the lessons derived from Munger’s multidisciplinary cognitive frameworks began to shape my decision-making process. The Circle of Competence, inversion, and the latticework of mental models became invaluable tools in analyzing risks, identifying opportunities, and making informed choices.

Example of Charlie’s Mental Models – Circle of Competence

One of Munger’s key mental models is the “Circle of Competence.” This concept advocates staying within one’s area of expertise and understanding. In practical terms, it means focusing on industries and businesses one knows well. Applying the Circle of Competence in my investment journey involved critically assessing my knowledge and comfort levels with different sectors. This mental model became a guiding principle, ensuring that I made informed decisions in areas where I had a genuine understanding.

Example of Charlie’s Mental Models – Inversion

Inversion is another powerful mental model in Munger’s toolkit. Rather than tackling a problem directly, inversion involves looking at it backward—considering how to avoid failure rather than solely focusing on achieving success. In the context of investments, this meant actively identifying and mitigating risks. Applying inversion, I learned to ask crucial questions such as, “What could go wrong with this investment?” This proactive approach to risk management significantly enhanced my decision-making process.

Building a Latticework of Mental Models

Munger doesn’t advocate relying on a single mental model; instead, he encourages the construction of a latticework—a network of interconnected models. This approach involves using multiple models simultaneously to gain a more comprehensive understanding of a situation. The latticework became a mental framework through which I analyzed investments, considering factors from various disciplines. It allowed for a more nuanced and thorough evaluation of opportunities and risks.

Example of Applying Mental Models in Entrepreneurship

As my career progressed, the need to address vulnerabilities in the financial markets – from counterparty risk to debt servicing to bank solvencies – became apparent, particularly in the aftermath of the Global Financial Crisis (GFC). Drawing on the principles of inversion and a thorough risk assessment, I recognized the necessity of creating a platform that offered access, liquidity, and utility for real-world assets like gold and silver. This realization culminated in the founding of Rush, a venture designed to help investors navigate the challenges of financial markets by offering a tangible and secure investment avenue.

Rush: Navigating Real-World Challenges

Rush stands as a testament to the application of Munger’s mental models in real-world scenarios. By acknowledging the potential pitfalls and learning from historical financial crises, Rush was conceived as a solution to provide investors with access and liquidity to an asset class with lower correlations to stocks and bonds. The business model aligns with Munger’s emphasis on long-term thinking and the creation of resilient structures in the face of uncertainties.

Conclusion

In weaving together the threads of early investments, career experiences, and the profound influence of Charlie Munger’s mental models, my journey in the financial realm has evolved into a comprehensive and strategic approach to investments. The combination of gold and Berkshire Hathaway stocks laid the groundwork for understanding stability and wisdom, while the application of mental models became the compass navigating the complexities of risk management, private equity, and entrepreneurship. The establishment of Rush encapsulates the culmination of these learnings, offering a tangible solution to the challenges observed in financial markets. The synergy of these elements underscores the enduring impact of early decisions, continuous learning, and the timeless wisdom of financial luminaries like Charlie Munger.