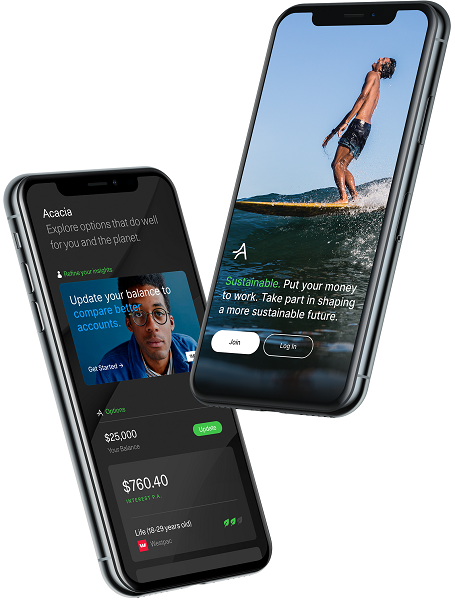

New Fintech Acacia helps people spend, save and build wealth in a sustainable way

Acacia, a fintech using the latest micro-service and cloud-based technology architecture and capitalising on open banking, is launching its app 23 August 2021.

Acacia’s mission is to enable more informed and convenient financial choices that help people to save money and build wealth, while having a positive impact on the planet.

The Acacia app gives consumers simple, sharp insight into their financial arrangements. It is the first fintech to use open banking and data analytics to optimise finances from both a financial and environmental viewpoint.

Integrated into the Acacia app are sustainable analysis tools that will help users to understand their carbon footprint and the environmental impact of their financial and energy arrangements. Acacia’s initial offer will incorporate savings accounts, mortgages and energy providers alongside sustainable spending analysis. Super and investment solutions are in the pipeline.

Unlike prevalent fintech offerings that have been designed around specific financial products, Acacia’s app is designed around the client experience and enables smarter financial choice across a broad range of products and providers.

The launch coincides with the findings of the newest IPCC report, released last week, providing valuable insight into the harsh reality of what’s to come if immediate action is not taken to drive strong and sustained reductions in emissions of carbon dioxide (CO2) and other greenhouse gases.

Despite the critical role of Australia’s financial system in tackling climate change, the big four banks have lent A$82bn to fossil fuel companies since the Paris Agreement in 2015 and only 20% of the top 20 superfunds have targets in place to achieve net zero emissions by 2050.

IBISWorld forecasts that the percentage of Australians that are concerned about environmental issues will increase by 3.5 percentage points in 2021, to reach 86.8%.

Acacia is making it easier for people to act on their beliefs by enabling increased transparency on the sustainability credentials of providers and at the same time offering more convenient financial choices.

After 23 years developing financial platforms including leading the design and development of BT Panorama, Westpac’s flagship wealth management platform, Anil Sagaram, Acacia’s Founder and CEO, has a unique lens on the Australian financial services sector.

“Australians are changing the way they make their purchasing choices and the way they manage their money. They are moving away from traditional banking and there is growing interest in not just doing well, but also doing good,” Sagaram said.

“Given the widening intergenerational wealth gap and the current generations focus on social values, it’s important to be transparent on not just the financial but also the longer-term environmental impact of money management.

“To put it into perspective, an average 40-year-old with a $60k super balance and a $353k mortgage, would be $286k better off when they retire at 65 by choosing a top quartile mortgage and super provider.

“And, with many great providers now delivering on both financial and sustainability outcomes, we think there’s a real opportunity to take the friction out of the process and make it easy for people to do good and do well.

“While the financial services sector is going through an upheaval as the banks exit their wealth management businesses and financial advice is becoming less affordable, Acacia will offer consumers a simple one-stop-shop to understand and optimise their financial arrangements.

“Acacia allows people to make smart financial decisions that align with their values from the palm of their hands,” Sagaram added.

“The Acacia platform enjoys the advantage of not being constrained by legacy in either its business model or technology architecture. It’s about moving beyond this historical focus on financial products and delivering more transparent and rewarding experiences that are designed around the client and helping them to manage their money in line with their values.

“We think our open architecture approach will deliver better outcomes for people and the planet, and allow us to build deeper, more relevant and more trusted client relationships,” Sagaram finished.

The Acacia app will be available for download from the Apple App Store and Google Play from Monday 23 August 2021.