Nervous investors pulled capital from equity funds in Q1 at fastest rate since pandemic began

Australian investors pulled more capital out of managed equity funds in the first quarter of 2023 than at any time since the beginning of the pandemic, according to the latest Fund Flow Index from Calastone, the largest global funds network.

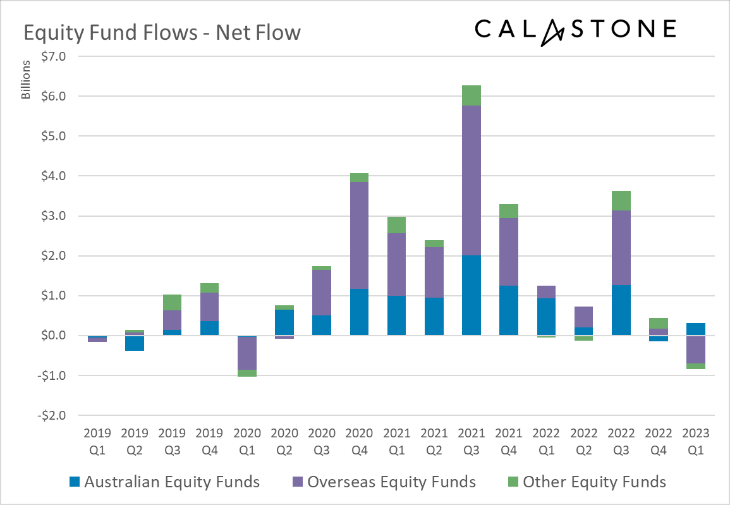

Outflows reached a net A$516m between January and March, the first quarter to see capital leave equity funds in three years. The loss of optimism follows a cautious fourth quarter – inflows then were a minimal A$296m.

Figure 1: Calastone net equity managed fund flows, all AU domiciled

Uncertainty over outlook for interest rates, inflation and global growth is driving a cycle of market ups and downs

Although January initially saw strong buying activity as investors cheered rising stock prices here and abroad, February more than reversed January’s inflows as global markets deflated. With the world taking its lead on interest rates from the US Federal Reserve, comments on 6th March that rates would need to go higher for longer to contain inflation ensured that selling remained the order of the day during the month. Calastone’s figures did not, however, show any marked uptick in local selling from the collapse of SVB or Credit Suisse. Outflows were fairly evenly spread across the month.

Teresa Walker, Managing Director of Australia and New Zealand at Calastone said, “The ASX has been trading within a range over the last three months, rising and sliding in lockstep with global markets. It is too early to call a definitive end to the global bear market – rallies in the first quarter mainly reflected a cycle of flurries of optimism that financial conditions were easing, followed by fears they were not. The bigger picture is that, globally, corporate earnings are under pressure and inflation is proving uncomfortably sticky both here in Australia and elsewhere. The Reserve Bank held interest rates steady this month, going into ‘wait and see’ mode and long bond yields are falling indicating fears of a slowdown ahead.”

Domestic funds prove much more attractive than those investing overseas

There was a clear preference for domestic equities in the first quarter. Australian investors added $319 to equity funds investing in shares listed on the ASX. Meanwhile they withdrew capital from every overseas category of equity fund, with the large global sector seeing its first quarterly outflows since the second quarter of 2020 – a net A$617m. They were also negative on specialist sector funds (mainly those focused on infrastructure) for the first time since the second quarter of 2022, withdrawing a net A$55m.

Teresa Walker added, “Australia’s stock market is performing in line with its global peers, yet investors drew a marked dividing line in Q1 between home and abroad.

“This reflects a clear structural, long-term bias in favour of investing in domestic Australian equities. Over the last four years domestically focused funds have absorbed more than a third of the A$28bn Australians have added to their managed equity holdings, with almost all the rest flowing into funds investing overseas. This is despite Australian equities accounting for only 2% of global market cap and having a distinct sector bias. From a risk and long-term growth perspective, it’s easy to argue for a more globally diversified approach.”

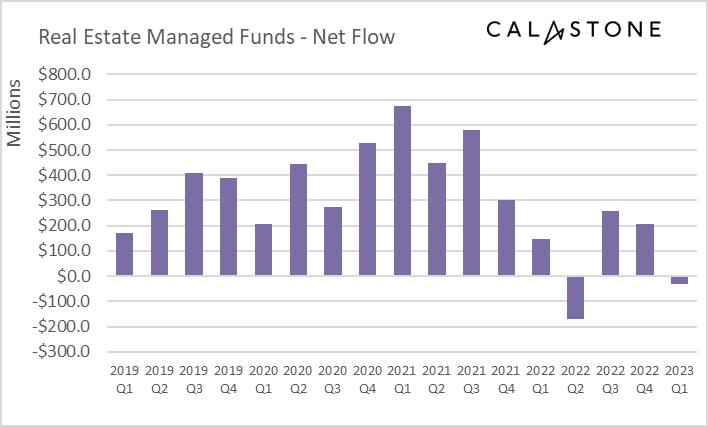

Real estate funds suffered first quarterly outflow since Q2 2022

Among other asset classes, real estate saw its first quarterly outflow since Q2 2022, only the second quarter on Calastone’s record that investors have withdrawn capital from the sector. The net outflow was a modest A$30m. Most recent quarters have continued to see inflows but at a lower level than the average for the last few years.

Figure 2: Calastone net real estate managed fund flows, all AU domiciled

Teresa Walker explained, “Commercial real estate is triply vulnerable when interest rates are high or rising. First, higher rates impact demand – lower occupancy affects rents paid to investors. And secondly, the sector uses more leverage than most so higher interest costs bite into profit margins. Finally, property values are also very sensitive to the higher cost of capital. Australia’s strong growth over recent years has supported the domestic real estate sector, but it is not immune to these realities. The start of the global rate-rise cycle over a year ago quickly caused a sharp drop in net inflows to real estate funds, driven mainly by a buyers’ strike rather than a big increase in sell orders.”

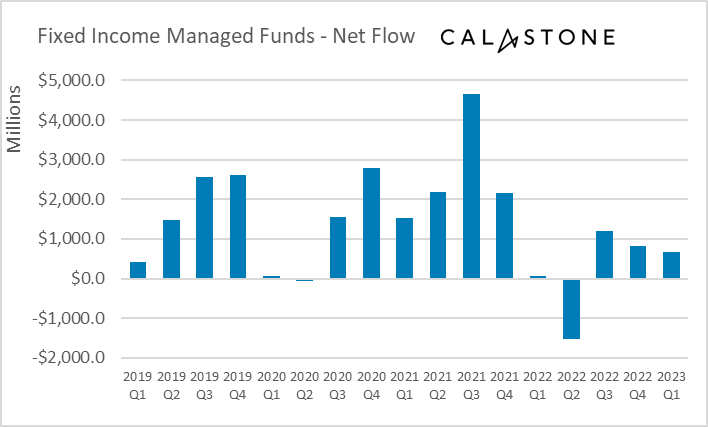

Fixed income funds saw inflows in January and February turn to profit-taking in March

Elsewhere, investors continued to add capital to fixed income funds, though the net A$664m in the first quarter was at a lower level than over the previous six months. In March, bond funds shed A$200m of capital on the back of a very marked uptick in sell orders as well as a more modest decline in purchase activity.

Figure 3: Calastone net fixed income managed fund flows, all AU domiciled

Teresa Walker said, “The yield curve has flattened out over the last three months, with longer-term bond yields falling sharply in March, reflecting expectations of slower economic growth. At the same time short-term yields rose in response to Reserve Bank rate hikes. This has generated capital gains for many fixed income investors and led to profit taking in March. Lower yields have also reduced the attractiveness of bonds for new capital compared to six months ago.”

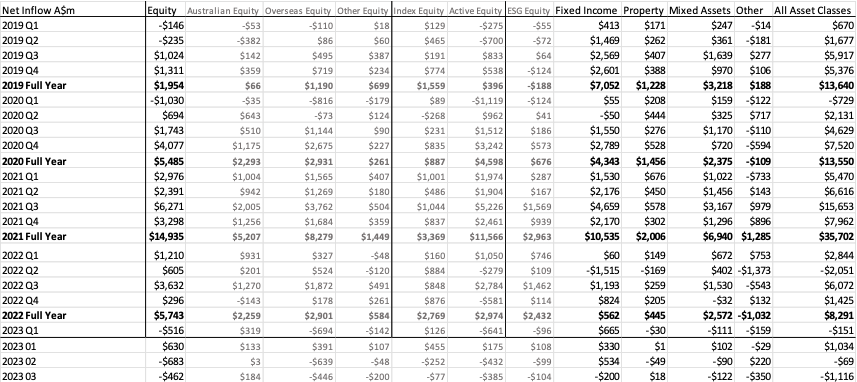

Figure 4: AU domiciled Fund Flow Data recorded across the Calastone Network (A$m)

Methodology

Calastone analysed over half a million buy and sell orders every month from January 2019, tracking capital from advisers, platforms and as it flows into and out of managed funds. Data is collected until the close of business on the last day of each month. A single order is usually the aggregated value of a number of trades from underlying investors passed for example from a platform via Calastone to the fund manager. In reality therefore, the index is analysing the impact of many millions of investor decisions each month.

More than 95% of Australian managed fund flows pass across the Calastone network each month. All these trades are included in the FFI. To avoid double-counting, however, the team has excluded deals that represent transactions where funds of funds are buying those funds that comprise the portfolio.

The index is a measure of investor conviction, placing the net flow of capital into the context of overall trading volumes. It also allows the reader to compare flows in asset classes of different sizes – A$100m of inflows may be very large for a small, relatively new asset class like ESG equity but very small for a huge category like fixed income. A reading of 50 indicates that new money investors put into funds equals the value of redemptions (or sales) from funds. A reading of 100 would mean all activity was buying; a reading of 0 would mean all activity was selling. In other words, $1m of net inflows will score more highly if there is no selling activity, than it would if $1m was merely a small difference between a large amount of buying and a similarly large amount of selling.

Calastone’s FFI considers transactions only by Australia-based investors placing orders for funds domiciled in Australia. The majority of this capital flow is advised and via platforms.