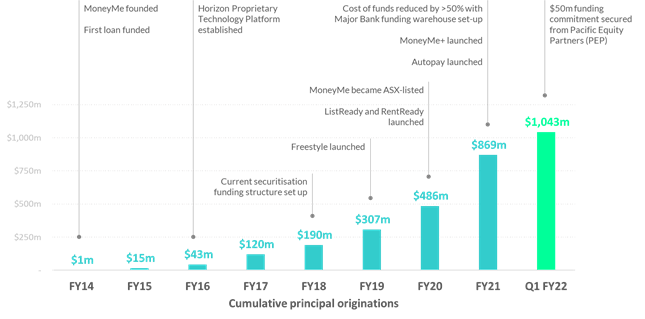

MoneyMe hits $1 billion in originations

ASX-listed fintech MoneyMe Limited has passed the $1 billion originations milestone with record quarterly revenue of $23 million, record originations of $173 million and gross customer receivables of $452 million for Q1, while continuing to see an increase in receivable credit quality.

Clayton Howes, MoneyMe’s Managing Director and CEO said, “I am delighted to announce that MoneyMe has passed the $1 billion origination milestone. This reflects our consistent focus over time to invest in and develop the digital capabilities of our Horizon technology platform, an unrelenting focus on the Generation Now customer and our persistent innovation.

“The record revenue, originations and customer receivables demonstrate our business is continuing to accelerate even in the face of extended lockdowns. At the same time credit quality is being maintained, and we’re seeing our diversified product and distribution strategy paying off. This quarter’s results demonstrate Autopay is gaining significant traction, with dealerships and brokers signing up to the new platform and a faster than expected take-up from car purchasers.”

$1 billion in customer receivable originations milestone passed

MoneyMe has originated $1,043m of gross customer receivables to 30 September 2021, a significant milestone from its initial start-up in 2013. Some key developments that have supported achievement of this milestone are referenced in the chart below.

Record Originations & Gross Customer Receivables

Originations have remained strong despite extended lockdowns with the MoneyMe achieving $173m in Q1 FY22 representing an increase of 283% on the prior comparable period ($45m, Q1 FY21) and are 8% higher than the previous (Q4 FY21) quarter record of $161m.

Personal Loan and Freestyle continue to contribute the majority of originations, maintaining strong performance during the lockdown period alongside ListReady and MoneyMe+. Autopay achieved significant growth despite the challenges for car buyers during lockdown, achieving originations of $37m in Q1 FY22 representing an increase of 479% on the previous quarter ($6m, Q4 FY21).

Gross customer receivables of $452m were 227% above the prior comparable period ($138m, Q1 FY21) and 36% higher than the prior quarter ($333m, Q4 FY21). MoneyMe’s continued growth in gross customer receivables during the lockdown period is a reflection of the diversified product strategy being successfully implemented.

Record Revenue & Contracted Revenue

Revenue increased to $23m for Q1 FY22, up 92% on the prior comparable period ($12m, Q1 FY21), higher than Q4 FY21 revenue by 21% ($19m, Q4 FY21).

Returns are strong with the average receivable term increasing to 41 months (37 months, Q4 FY21) and the average receivable size increasing to $12,950 ($10,200, Q4 FY21), increasing the average contract life-time value to $124m ($98m, Q4 FY21).

Further Funding Runway For Growth

MoneyMe increased overall external commitment in its Major Bank warehouse funding facility to $426m ($250m, Q4 FY21) on 8 October. The increase was made to the both the senior and mezzanine note investments with a slight further overall reduction in the cost of funds. The increase is well timed to provide MoneyMe with additional resources to be able to continue to fund its accelerating originations growth. It reflects the ongoing funding appetite of the Group’s key funding partners and their confidence in MoneyMe’s operating processes.