MONEYME Delivers Record Revenue And A Step Change In Scale

MONEYME Limited is pleased to provide this trading update to 31 March 2022.

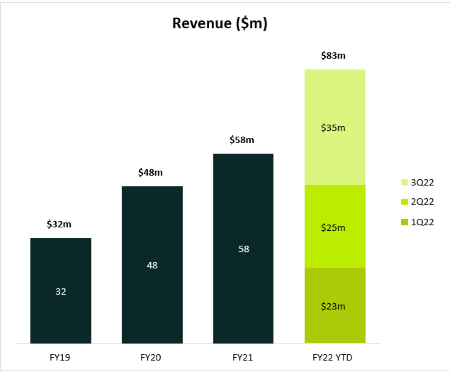

MONEYME grows revenue2 by 141% to a record $35m for 3Q22 with record contracted revenue3 of $345m and gross customer receivables of $1.2b for 3Q22.

3Q22 Trading Highlights

- Record revenue of $35m, up 141% on pcp ($15m, 3Q21; $25m, 2Q22)

- Contracted revenue of $345m, up 94% on the prior quarter ($178m, 2Q22)

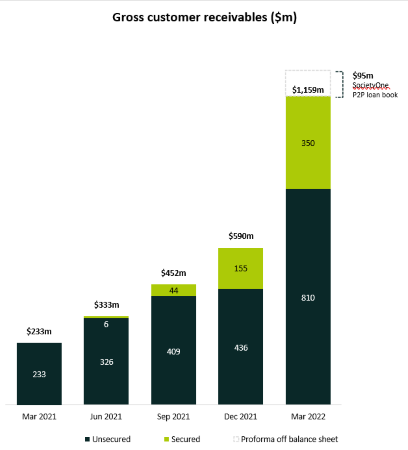

- Gross customer receivables $1.2b, up 398% on pcp ($233m, 3Q21; $590m, 2Q22)

- Originations of $340m (46% secured loan assets), up 215% on pcp ($108m, 3Q21; $268m, 2Q22)

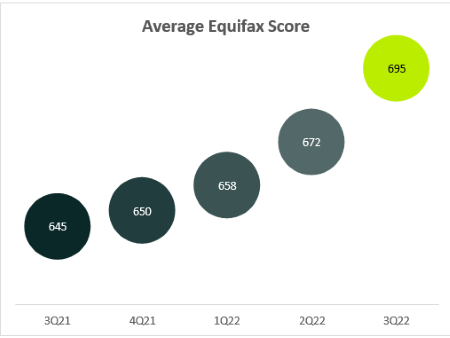

- Closing average Equifax Score increased to 695 (645, 3Q21; 672, 2Q22)

- Net losses of 3% (4%, 3Q21; 4%, 2Q22)

- External debt funding capacity increased to $1.4b

Clayton Howes, MONEYME’s Managing Director and CEO said:

“MONEYME continues to outperform with rapid revenue and loan book expansion. With 46% of originations being secured against car assets the credit quality of the book is increasing. The products, technology and customer experience continue to lead the organic growth advantage for the business.

I am delighted to include SocietyOne in our results from the acquisition on the 15th March 22, and look forward to a full quarter of revenue and originations being included in the results for our 4Q22. We have already made great progress with the integration of SocietyOne and are on track to realise the enormous synergy benefits.”

SocietyOne Acquisition Driving Immediate and Long-Term Growth

The acquisition of SocietyOne increased the Group’s Gross Receivables at the end of 3Q22 by

$356m on a statutory basis and by $452m on a proforma basis (that includes loans under SocietyOne’s managed peer to peer program).

The key benefits of the acquisition include boosting revenue, customer and profit growth;

- Material cost synergy opportunities: $17m p.a. (pre-tax) from FY24 by removing duplicate functions, systems, premises, processes and lowering funding

- Revenue opportunities from SocietyOne customer base: $15m p.a. (pre-tax) revenue synergies from FY24 by marketing MONEYME’s diverse product suite to SocietyOne’s unique customer

- Unlocking new distribution opportunities: Leverage the Credit Score product with

~158k customers (a low-cost channel), expand the broker sales channel and the Banking-as-a-Service partnership opportunity with Westpac.

The post-acquisition integration (‘Project Fusion’), is progressing well with several important milestones achieved in 3Q22:

- Acquisition successfully completed according to plan on the 15th March 2022

- New Executive Team appointed and announced

- The 1st of 2 stages of the people and premises cost reduction plan is

The 4Q focus for Project Fusion is to:

- Initiate cross-selling to leverage the Credit Score customer base

- Initiate the implementation of the technology integration onto Horizon

- Execute the 2nd stage of the people cost reduction

Record Revenue & Contracted Revenue

Revenue increased to $35m for 3Q22, up 141% on the prior comparable period ($15m, 3Q21), continuing the revenue growth from 2Q22 ($25m). This revenue result included $2m of SocietyOne revenue for 16 days, accounting for revenue from the 15th March 22 acquisition date.

Increasing returns with the average remaining receivable term increasing to 50 months (47 months, 2Q22), the average receivable size at origination increasing to $19,284 ($16,622, 2Q22), with the future contracted revenue value increasing to $345m ($178m, 2Q22).

Record Originations & Gross Customer Receivables

Originations continue to accelerate with increasing demand, achieving $340m in 3Q22 representing an increase of 215% on the prior comparable period ($108m, 3Q21) and are 27% higher than the previous 2Q22 record of $268m. Secured originations for 3Q22 represent $158m (46% of 3Q22 Group originations), while unsecured originations are $182m (54% of 3Q22 Group originations).

Autopay continues to grow significantly and gain market share, adding significant scale with dealers and brokers signing onto the platform. The business has over 380 dealers and 950 brokers with access to Autopay.

Gross customer receivables of $1.2b4 were 398% above the prior comparable period ($233m, 3Q21) and 96% higher than the prior quarter ($590m, 2Q22). $356m of gross customer receivables at 31 March 2022 relate to the acquisition of SocietyOne. The Group’s continued growth in gross customer receivables during the lockdown period reflects the diversified product strategy being successfully implemented.

Strong Credit & Book Quality With Further External Funding Capacity Increases

Credit and book quality metrics continue to perform within planned ranges with net losses at 3% for 3Q22, down slightly from 2Q22 (4%). 3Q22 net losses includes some recovery income following an aged debt sale completed in December 2021.

The closing average Equifax score was 695 for 3Q22, increasing from 645 in 3Q21 and 672 for 2Q22. The business continues to be well positioned through its diversified customer receivables in the continuing COVID-19 environment.

The Group increased its external funding capacity to $1.4b in the quarter. The Group’s facilities now include funding from 2 major Australian banks and 2 major international banks. Further capacity increases are planned to support gross receivables growth.