MONEYME changes the game of vehicle financing with the launch of AutoScan

One of Australia’s leading non-bank consumer lenders MONEYME is shifting CX to the next gear after unveiling Autopay’s soon-to-launch AutoScan feature for real-time, personalised financing insights on the showroom floor.

MONEYME today announced the next phase of Autopay’s evolution with an exciting new feature that will streamline the customer experience for vehicle financing.

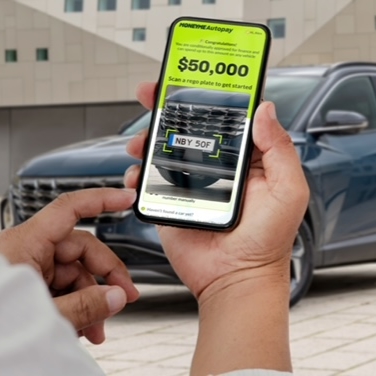

Launching in the first quarter of FY23, Autopay’s new AutoScan feature will allow customers to access loan and repayment details for vehicles on the showroom floor, simply by scanning the registration plate of any vehicle on display.

Autopay will be the first vehicle financing product to offer the Australian automotive industry this capability.

MONEYME CEO Clayton Howes said Autopay is a remarkable Aussie success story after already delivering over $300 million in originations (as at 31 March 2022) since its launch in April last year and a 94% increase in gross customer receivables in 3Q22 compared to the previous quarter, with high growth continuing.

“MONEYME is driven by our commitment to provide Australians with best-in-class speed and the most innovative technology available when it comes to consumer finance. The launch of AutoScan is a natural part of Autopay’s evolution as it simplifies and speeds up the process of vehicle financing for both customers and dealerships.” CEO Clayton Howes said.

Autopay enables car dealerships and brokers to submit applications for secured vehicle finance on behalf of their customers via Autopay’s self-service portal.

According to Alex Luther, Partnership Director for Autopay, customers are able to receive approval and settlement in as little as 60 minutes, and drive home in the comfort and satisfaction of their new car.

“Autopay is helping more Australians get back on the road with a loan application process that is simple and seamless.

“Already the fastest vehicle finance provider in the Australian market, Autopay is now breaking new ground in the automotive industry with a game-changing feature that we will be launching in the coming quarter.

“With the AutoScan feature, customers will be able to access real-time loan details and repayment plans for their dream car,” Autopay Partnership Director Alex Luther said.

The platform, which won the presitigous Canstar Innovation Excellence Award for 2022, has already seen remarkable momentum in its first 12 months.

Announced in MONEYME’s 3Q22 results, there were over 1300 dealers and broker partner signed up to the Autopay platform, a number that continues to grow consistently.

Alan Lishman, General Manager, Dutton Financial Services, is one dealer group that has seen a surging popularity for Autopay among its customers.

“Over the past 6 months, over 40% of our customers that have chosen to fund their car have done so via Autopay, which are incredible numbers for a financing solution that’s only one year old. They have completely taken the friction out of auto finance and no other lender can seem to match their speed,” he said.

“Dutton Group is committed to providing our customers the very best in on-site vehicle finance. MONEYME matched our ambitions with Autopay’s innovative, smart and flexible vehicle financing platform that allows customers to get the instant support, comfort and security they need when buying a car.”