Superhero reveals its most-traded stocks of 2022

Superhero, a leading share trading and superannuation platform, has today released its annual Year in Trades review, digging into the most-traded assets on its platform in 2022.

Every day, Superhero’s platform sees thousands of trades made with its 220,000 customers investing across all sectors – from resources to financial services to technology and more.

In a shake up from 2021, last year’s most traded Australian company, Zip (ASX:Z1P) has fallen off the most traded list for 2022. Instead, it looks to be the year of lithium and resources with four of the top five most traded AU shares all in the resources sector.

The top five most traded Australian companies between 1 January 2022 and 30 November 2022 (inclusive) were:

- Core Lithium (ASX:CXO)

- Pilbara Minerals (ASX:PLS)

- Fortescue Metals Group (ASX:FMG)

- Brainchip Holdings (ASX:BRN)

- BHP (ASX:BHP)

Core Lithium (ASX:CXO) was popular across Australia, taking home the coveted position of the most traded stock in seven of the eight states and territories. Tasmania was the only state to deviate, but not too far from the lithium craze with Lithium Energy Limited (ASX:LEL), the most traded Australian stock in the island state.

Over on Wall Street, Tesla (NASDAQ:TSLA) held onto its title as the most traded US share in 2022 with Apple (NASDAQ:AAPL), Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN) and Microsoft (NASDAQ:MSFT) making up the rest of the top five. For ETFs, the ProShares UltraPro QQQ ETF (NASDAQ:TQQQ) overtook the Vanguard S&P 500 ETF (NYSE:VOO) to be the most traded US ETF in 2022.

CEO and co-founder of Superhero, John Winters said, “Despite ongoing volatility throughout the year, our customers continued to invest with trading volumes consistently up month-on-month. Locally there was a clear interest in resources – particularly lithium – with the top two traded Australian shares both being lithium stocks.”

“On Wall Street, tech remained a huge focus for Superhero investors. Interestingly, following on from 2021, where three EV (electric vehicle) companies made the top five most traded US share list, only Tesla managed to hold its place on 2022’s list.”

Both Core Lithium and Tesla were the two most followed companies on the Superhero platform – referring to the Follow feature available on the Superhero platform. Furthermore, customers with Minor Accounts looked to follow on from their strategies with their personal investments with Core Lithium and Tesla the most traded Australian and U.S. shares for Minor Accounts. There was deviation with ETFs with the Vanguard Australian Shares Index ETF (ASX:VAS) and Vanguard S&P 500 ETF (NYSE:VOO) the most traded Australian and U.S. ETFs for Minor Accounts in 2022.

BUY NOW SELL LATER

Overall in 2022, net buy trades significantly outnumbered net sell trades – with seven out of 10 trades on Superhero this year a buy trade. Interestingly, when it came to ETFs (both Australian and U.S.), 83 per cent of trades were buys, indicating that investors were continuing to build their portfolios through the diversification provided by ETFs.

Winters said, “Over the last two years Superhero has been in market, we’ve seen our customers grow and evolve. There’s an understanding that markets work in cycles and as such the volatility we saw this year has been accepted as a natural market event – and an opportunity to continue building their wealth through investing. We have not seen the volatility deterring investors.”

GEN WHAT?

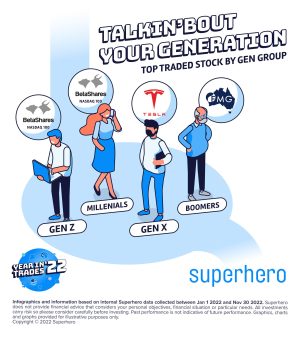

Generationally, there were clear trends in how Superhero customers invested. For both Gen Z and Millennials, the Betashares Nasdaq 100 ETF (ASX:NDQ) was the most traded stock. Gen Z investors had a distinct preference for ETFs, with the Vanguard Australian Shares Index ETF (ASX:VAS) and the Vanguard Diversified Balanced Index ETF (ASX:VDBA) making up the top three most traded stocks for 18 to 25 year olds on the platform.

ETFs were more popular with younger investors with approximately half of Superhero customers between 18 and 32 trading either Australian or U.S. ETFs in 2022.

“Given the volatility in the market this year, it’s unsurprising to see our investors, particularly younger investors, look to ETFs as a way to build their portfolios. Overall we’ve seen more buy trades over sell trades and for ETFs, four in five trades made by Gen Z’s and Millennials were buys, indicating a long term strategy to consistently build their portfolios,” commented Winters.

Meanwhile, Gen X investors looked to Tesla (NASDAQ:TSLA) followed by Core Lithium (ASX:CXO) – with the latter the top traded Australian stock for Gen X. Baby Boomers on Superhero were more inclined to invest in shares over ETFs, with Fortescue Metal Group (ASX:FMG), Core Lithium (ASX:CXO) and Pilbara Minerals (ASX:PLS) the top three traded stocks for over 55s.

A COUPLE OF LAUGHING STOCKS

2022 also saw the re-emergence of meme stocks, particularly in the US market, with Reddit and social media platforms once again sparking interest in certain companies.

In August, we saw a 345 per cent spike in trades of Bed Bath and Beyond (NASDAQ:BBBY) week-on-week, making it the second-most traded US stock that month after perennial favourite Tesla.

Companies like Revlon, AMC (NYSE:AMC) and Gamestop (NYSE:GME) also saw renewed interest from investors with both Bed Bath and Beyond and AMC making the Top 10 most traded stocks in August. Interestingly, Bed Bath and Beyond saw the biggest percentage increase in trade volumes year on year for US shares.

Winters noted, “The popularity of so-called meme stocks in August 2022 was a fascinating event. We saw investors flock to Bed Bath and Beyond in the first half of the month and the continued hype around these meme stocks throughout the month, catapulted them into our top traded lists for August.”