Mastering Fintech Growth: Lessons from the coalface of Marketing

According to last year’s report from Boston Consulting Group (BCG) where Fintech was described as having ’exploded’ in the past two decades globally, with anticipated massive (six-fold) growth over the next seven years, the Asia-Pacific region is poised to outpace the US and become the world’s top fintech market by 2030.

The region has been identified as a hotbed for Fintech innovation, particularly for Australian Fintech start-ups in the digital advice realm, responding to the complex financial needs of an ageing demographic.

In this article, key marketing lessons learned from the coalface of marketing a Fintech are shared from senior industry marketer, Neil De Beger.

Breaking Silos: The Agile Marketing Approach in Fintech

In the dynamic world of fintech start-ups, adaptability and a robust marketing strategy are the cornerstones of growth. Whether you’re laying the groundwork or scaling rapidly to meet market demands, it pays to have a well-crafted marketing plan and it acts as your north star.

Unlike the segmented operations of large corporations, fintech start-ups demand versatility and a holistic approach. Here, being a ‘Jack of all trades’ is not just common but most likely necessary, to thrive.

Startups thrive on agility and a multi-disciplinary approach. In fintech, the absence of silos promotes versatility, necessitating a marketing strategy that’s both adaptable and steadfast.

The early stages of a start-up are fast-paced and can be thrilling. It changes at warp speed and comes with many challenges, just as it does the opportunities.

So, you might ask yourself how you’re supposed to do your job efficiently and does working in a Fintech also mean that you need to change your marketing approach?

It might!

The Agile Marketers Edge

In this fast-paced environment, agility isn’t just an advantage—it’s a requirement. Access to customers and direct feedback is like gold in refining your Minimum Viable Product (MVP) and overall market strategy.

Being involved in the very early stages of a start-up means exposure to areas of a business that you wouldn’t necessarily have, within a larger organisation. Yes, it comes with challenges and you must embrace that everyone is on the same level playing field, ready to roll up their sleeves to get the job done. You have to ‘muck-in’ too.

For a marketer though, you gain invaluable access to the customer and on a frequent basis, which is like holding a winning ticket!

It’s a dynamic and fluid environment but the fundamental approach to marketing does not change.

If you take a strategic approach and keep the customer at the core of your plan, you are much more likely to succeed.

Strategic Marketing for Maximum ROI

A strategic marketing plan is still important – it serves as the blueprint for focus and direction in a start-up. It’s about understanding the market, pinpointing your target segments, and establishing a unique proposition that sets you apart.

The planning process is critical. A skilled marketer understands that they are not the customer and seeks to understand their audience. In a Fintech, this can be as simple as engaging in conversations with potential customers or, even better, visiting their work environment (eg. to validate your MVP).

Gaining such insights and comprehending the market, will help you to identify the key segments and your target audience and also, help you to firm up your positioning, to each one.

Contrary to what you may think, and based on my experience, having one or two other companies offering similar services, solutions, or products can be beneficial for a Fintech. Often, the market is substantial enough to accommodate multiple players and among other things, it reassures you that you are on to something!

What truly matters is that you have a distinct and well-defined positioning, against your competition. It’s essential to have clarity from the outset, so that customers understand why they should choose you first.

Enhancing Customer Experience Through Strategic Touchpoints

In Fintech, the customer journey is pivotal. Every interaction, from product demos to webinars, needs to be optimised for maximum effectiveness and conversion potential. This means embracing a culture of continuous testing and refinement.

It is also essential to have a laser-like focus on your target segments and determine which tactics within your marketing mix are feasible.

Having tangible measures is vital for determining the impact on the bottom line and identifying the areas where you see the highest returns, enabling you to provide accurate reports.

One advantage of working in a fast-growing start-up, is the benefit of a dynamic culture, with minimal bureaucratic hurdles. This agility allows for quick adaptation and execution since it also involves working closely together.

For the Fintech customer, it is key to remember that interaction with the product or service is often necessary before they make a purchase. This can take the form of free trials, product demos, training sessions, webinars etc. So, a philosophy of continuous testing, measuring, and optimising the mix is required.

Close collaboration with colleagues in Sales and Operations (and often, strong camaraderie!) is essential to helping map out the different steps, stages, and touchpoints, from lead capture and marketing activities to interactions extending past initial sale.

The process doesn’t even have to be overly complicated initially; you can add to it as you go. It provides a clear picture of what works and what doesn’t, which activities have greatest contribution to the sales, what is most effective for converting leads, and it helps identify areas for improvement.

Punching above your weight (and market share!)

For emerging Fintechs, brand building is about more than recognition—it’s about establishing trust. This means targeted marketing efforts that are both innovative and cost-effective, ensuring that every dollar spent works harder for you.

You won’t have the luxury of being able to run large-scale mass-marketing campaigns. You may even need to back yourself with some innovative and creative thinking to cut through with your identified target audiences.

You will need to build credibility, as your customers will need to be able to trust your product, or software.

It also means that you need to aim high and punch well above your weight with your marketing!

Crafting Your Fintech Marketing Strategy

To thrive in the fintech industry, it’s essential to define clear, measurable goals in your marketing and communications plan.

All too often businesses jump straight into tactics without defining clear, measurable objectives. Unfortunately, you then have no compass and it is easy to spend money on Google Ads or a flash CRM, without knowing what’s actually generating (quality) leads and the higher sales conversions. Fintech start-ups, often work with lean budgets, demanding judicious spending and sharp focus on both immediate and long-term objectives.

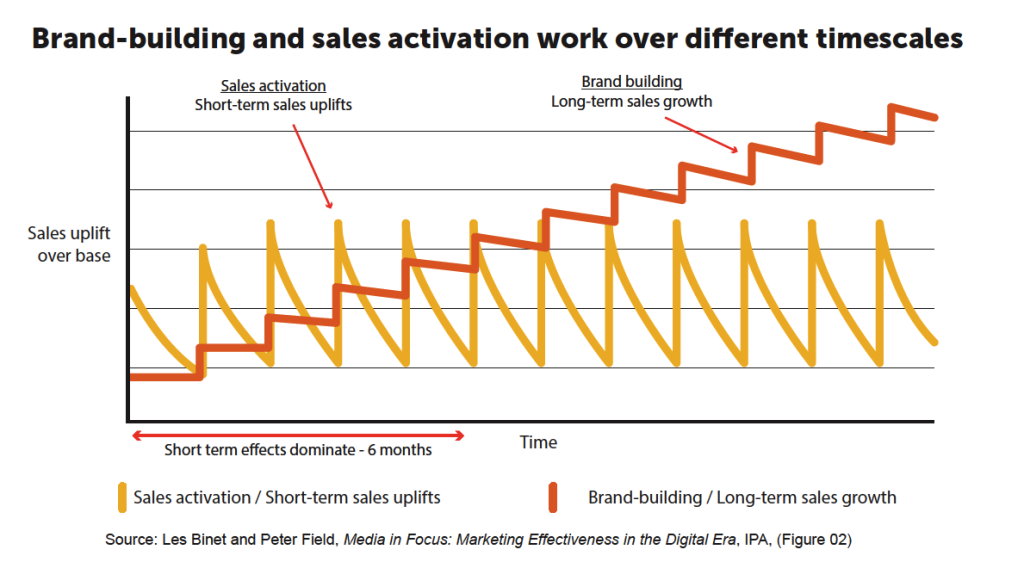

The financial health of a fintech start-up hinges on ‘activation’—prompting immediate customer response—and ‘brand building’—cultivating lasting customer relationships. A balanced investment of 60% in brand building and 40% in activation, as suggested by marketing experts Binet and Field, can drive sustainable growth and reduce dependence on paid acquisition channels.

However, remembering the lifeblood of your business and ongoing investment is sales, you are most likely to reverse the spend percentages in your first few years. The key is to create a balance between “activation” initiatives and “brand building”, which aims to establish a steady flow of sales, revenue, and profit in the present and future.

It is also worth noting that in a start-up where the lines are more likely to be muddied, brand building is not limited to the long term. An effective advertising or marketing campaign with a long-term focus will also yield positive short-term results.

Plus, a strong brand trajectory over time will also naturally attract more people to seek you out, reducing the reliance on paid channels for customer acquisition.

Leveraging Public Relations (PR) in Fintech

PR is crucial for enhancing brand visibility and engagement.

You can utilise analytics tools like GA, which can transform how you measure the success of your press coverage, to increased website traffic and social media engagement and through the funnel.

PR is an incredibly effective channel for enhancing brand, particularly in the early stages where eg. a well-crafted press release, coupled with a strong thought leadership piece (and good media relationships), can yield impressive results.

Traditionally, the success of a press release has been evaluated based on media coverage and reach, including mentions on social media – all valid “soft” measures. However, leveraging digital tools such as GA, you can significantly enhance this measurement. A good starting point is to analyse the sources of your website traffic. Establishing benchmarks or average performance by channel allows you to gauge success more accurately.

To amplify the cumulative impact across various mediums, consider running a targeted paid social media campaign alongside, to promote your content.

By integrating expertly crafted and ‘helpful’ content derived from a broader communications strategy, such as a free e-Book addressing specific customer needs and identified ‘pain-points’, you can align with your core positioning and key messages and effectively reach and attract potential customers. And they’ll appreciate you even more for it, even if they aren’t quite ready to purchase (most aren’t which is why brand building helps!).

This is where an integrated marketing communications strategy truly takes shape.

Aside from website traffic, leads captured through your website can provide further insights into the effectiveness of your communication efforts.

It’s crucial to proceed with caution to ensure proper setup for accurate measurement. Engaging in too many activities simultaneously can also make it challenging to attribute results accurately.

Integrating a Comprehensive Marketing Communications Strategy in Fintech

In Fintech, a cohesive marketing and communications strategy is essential for branding and market expansion. It’s about building a narrative that aligns with your brand’s core values and resonates with your audience.

An holistic communications strategy considers your business objectives, target audience, relevant key messages aligned with the segmentation strategy, appropriate channels, and desired outcomes. It outlines how your business or organisation should consistently and cohesively communicate its mission, values, products, or services.

A ‘successful’ strategy also articulates your business goals, understands the audience, and delivers consistent messaging across all platforms. It’s a strategic framework that integrates marketing, internal communications, and crisis management to support both immediate and long-term objectives.

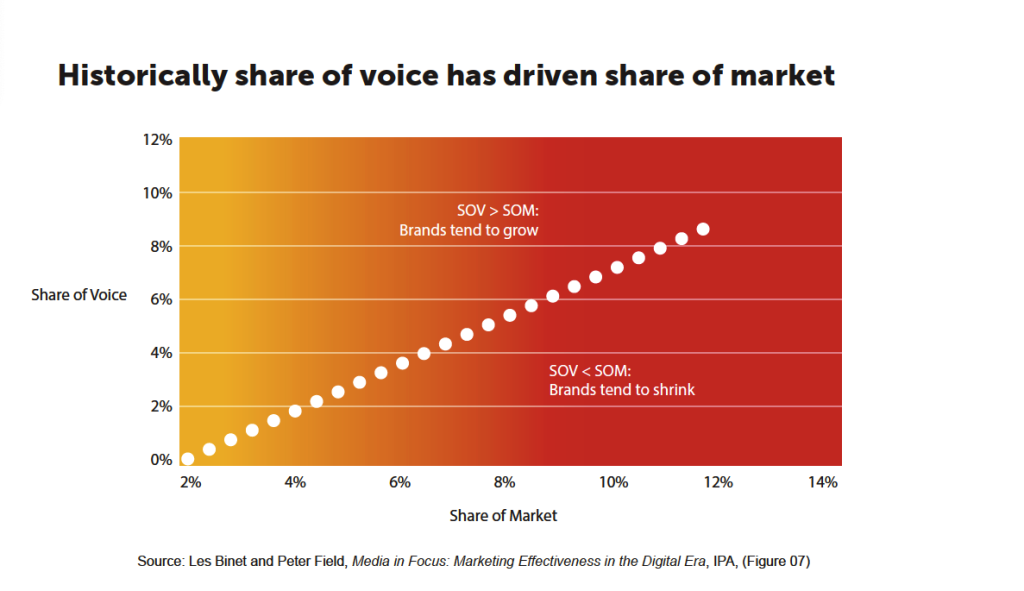

A great reminder of this comes from Binet and Field, who also determined, that the greater the Share of Voice (SOV) the greater the Share of Market (SOM) you will have.

Choosing the right marketing and communications partner

If your team lacks the capacity, resources, or expertise to handle your marketing and communications strategy internally, seeking external assistance from a business partner, consultant or agency is your best option.

For Fintech startups, choosing the right partner for your marketing an communications strategy and execution, can be a game-changer.

Outsourcing to an expert offers many benefits and as well as a personalised service, that then aligns with your vision.

Regardless of whether you choose an individual with strong skills or a small agency, certain fundamentals should be a priority for your chosen partner. They must possess excellent proven skills and share your long-term vision for the business. These skills and the services they offer, must also match what you are trying to achieve with your marketing and communications.

As a start-up or growing Fintech, you may not require all the bells and whistles offered by a large agency with lots of clients, promised efficiencies and a multitude of available resources. It’s often more costly for a start, when in fact, you might benefit more from a partner or consultant who operates in close collaboration with you and takes a more personalised approach.

A partner with proven credentials in your specific market, deeply understanding its nuances and your target customers, is more likely to be fully engaged with your business success, rather than treating you as one among many potentially larger clients.

Indeed, once you have a strategic framework and a agreed road-map, you may determine that you then only require help with specific elements.

A specialist marketing expert that offers more of a boutique approach, will also be highly receptive to assisting you in assembling these pieces to maximise your returns and impact from your target audience.

An invaluable partner is also one who truly comprehends your business and shares your excitement about its technology and growth potential.

Conclusion

In the fast-paced Fintech sector, marketing success is built on a foundation of deep customer understanding and strategic positioning. Prioritising these core principles sets the stage for sustained growth and outshining your competitors.

The most effective Fintech marketing strategies are rooted in unified goals and collaborative efforts. Embracing a culture of continuous improvement through constant testing and refinement can leverage customer proximity into valuable insights, driving your Fintech brand forward.

For Fintech start-ups, earning trust and establishing credibility isn’t optional—it’s essential. In a competitive landscape, your brand must exceed expectations and authentically connect with your audience to stand out.

Selecting a marketing partner for your Fintech venture involves more than ticking boxes; it’s about finding one that’s as invested in your success as you are.

Look beyond surface-level attributes and find a partner who is truly committed to your growth journey as the catalyst for substantial market impact. Seek personalised service that aligns seamlessly with your own marketing and expansion plans.

Neil De Beger (pictured), a Senior Marketer and former Head of Marketing for Moneysoft. He is also the Founder and Principal of OYM – Outsource Your Marketing.