Low-cost online broking platforms will continue to grow, disrupt large players in the ‘new COVID era’: Datt Capital

The effect of COVID-19 enhanced trading volumes by retail investors combined with a structural shift in the Australian online broking markets has led to smaller broking platforms like SelfWealth outperform larger competitors this year.

Emanuel Datt, Managing Director and Chief Investment Officer, Datt Capital notes: “Most low cost online trading platforms witnessed strong growth this year. We believe this growth cannot be looked at in isolation but is a validation of the structural shift we see in the Australian online broking markets.”

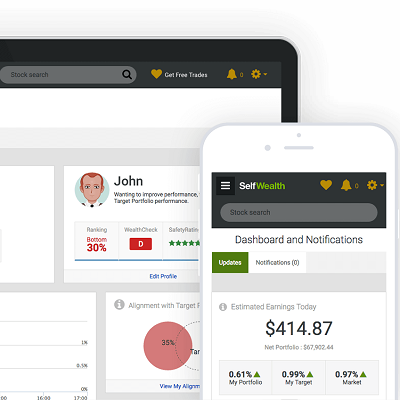

An outstanding example is SelfWealth, says Datt.

“SelfWealth is unequivocally the lowest cost provider in the market providing a large incentive for new users to try the service. This consequently leads to increased client ‘stickiness’. The platform is very stable and in the recent market volatility, outperformed it’s larger competitors (Commsec and Nabtrade) in terms of uptime.

“The latest quarterly release once again demonstrates the strong tailwinds the company is experiencing with quarter-on-quarter (‘QoQ’) growth in active traders of 44% compared to the previous quarter.

“Operating revenue and trade volumes grew over 100% and the company achieved its first-ever positive quarterly cashflow from operating activities. The value of client cash on the platform remained stable at $366 million despite very strong trade volumes. All these metrics affirm the company’s ability to capture a disproportionate share of trader ‘churn’ and subsequently increase its market share.

“We believe the company will be able to maintain its strong growth momentum given the market and product fundamentals whilst increasing the ‘monetisation efficiency’ of its platform. We expect this increase in monetisation to be driven by several organic growth initiatives the company has been working on that are projected to be rolled out over the next six months.

“The first is a revamp of the SelfWealth mobile application which we anticipate will be a market leader in customer usability and experience. It is a known fact that two factors are strongly aligned with customer satisfaction and use; consequently, we anticipate that this will lead to an increase in time spent on the platform and potentially a rise in trade volume.

“The second large initiative is the launch of US equity trading via the SelfWealth platform. The US equity markets are the larger and most followed in the world. The ability for SelfWealth customers to purchase direct shareholdings in global market leaders like Amazon and Google, will no doubt increase trade volumes on the platform and provide valuable diversification from reliance solely on local equity market trade volumes.

“One observation we have seen in high growth sectors is that scale begets scale. As the user base grows and broadens from its initial dominant user demographic, we often see the next leg of growth driven by strong uptake by broader mainstream society attracted by a compelling product offering. We believe we will observe a similar dynamic with SelfWealth going forward.

“SelfWealth remains strongly capitalised with cash holdings of over $5 million and no debt. We believe the company is in a position to maintain its current profitability as well as build upon its strong market and product position.

“We believe the company remains compelling long-term value at its current market value,” notes Datt.