LENSELL has announced a new feature in Diversiview

The team at LENSELL have announced a new feature in Diversiview.

This feature is unique on the market – Weighting Constraints in Portfolio Optimisation

Why Weighting Constraints?

When you calculate the Minimum Risk Portfolio, the Optimal Portfolio or Efficient Frontier positions, the Diversiview optimiser may allocate from a minimum of 1% to a maximum of 99% to any security, by default.

That may result in an allocation that, while mathematically correct, may not align with your preferences.

For example, one security may be given 1% while you’d prefer to have at least 5% in any given security if possible. Similarly, the optimiser may allocate 60% to one security, while you’d like to avoid having more than 20% in any security.

So, the team at LENSELL built in a new feature, unique on the market, that allows you to specify the minimum and maximum weight (percentage) that you want in any given security in your portfolio.

How to use this powerful feature?

- Create a new analysis in Diversiview (free, ad-hoc paid analysis or via your subscription).

The weights in the analysis will be your specified weights, or equal weighting will be assumed if no weights are specified.

- Go to ‘Calculate the Minimum variance portfolio’ or ‘Calculate the Optimal Portfolio’ (you can find these options in the ‘Explore your portfolio’ section at the end of the analysis page).

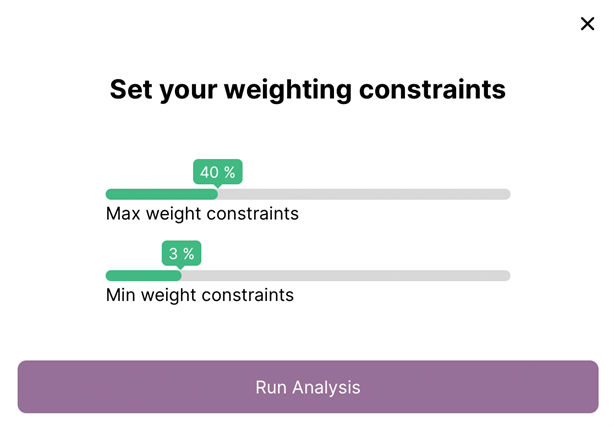

- On the popup form, move the selector to your minimum and maximum weight that you’d like to get when you optimise your portfolio.

(Example only, you should specify your own preferred weights)

- Run the analysis and check the composition (asset allocation) on the new analysis page created.

REMEMBER that all optimisation runs for one portfolio (i.e., calculating the Minimum Risk Portfolio, the Optimal Portfolio and discovering Efficient Frontier positions) are included in the paid analysis and do not count against subscription monthly limits.

So, you can analyse and optimise one portfolio as much as you want, as often as you want, until you find the allocation that works for you. ?

Diversiview by LENSELL is the #1 AI-based Portfolio Optimisation tool for active investors who want to boost their portfolio performance.

If you have any questions, contact the team at: [email protected].